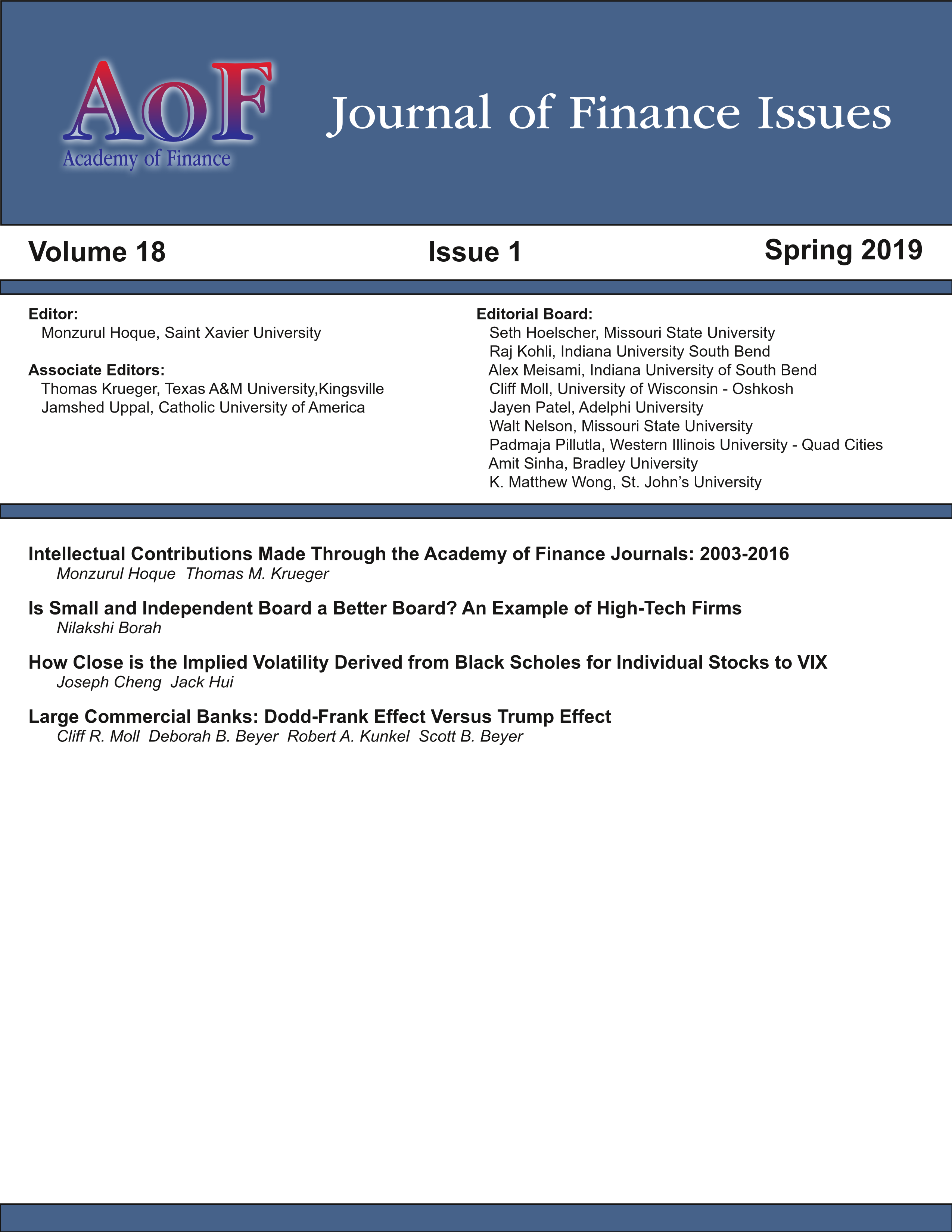

Large Commercial Banks: Dodd-Frank Effect Versus Trump Effect

DOI:

https://doi.org/10.58886/jfi.v18i1.2222Abstract

Large commercial banks have been financially impacted by both: (i) the Dodd-Frank Effect, which is the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and (ii) the Trump Effect, which is the presidential election of Donald Trump in 2016. It is well-known that the Dodd-Frank Act targeted large commercial banks with additional regulatory compliance costs such as the Dodd-Frank Act Stress Test (DFAST), the Durbin Amendment, the Volcker Rule, the Lincoln Amendment, and the creation of the Consumer Financial Protection Bureau. While the goal of the Dodd-Frank Act is to prevent another 2008 financial crisis, it imposes huge regulatory compliance costs on large commercial banks. The American Action Forum reported the compliance cost at more than $36 billion and 73 million paperwork hours. The Government Accountability Office (GAO) originally calculated compliance costs at $2.9 billion for the first five years, but the estimated cost published in the Federal Register was raised to $10.4 billion. Consequently, while seeking and securing the presidency, Donald Trump promised large commercial banks there would be regulatory rollbacks of the Obama-era legislation. In addition to examining the Dodd-Frank Effect and Trump Effect separately, we will examine the Combined Effect. This paper will add valuable knowledge to government policy makers on how the regulation and deregulation impacts commercial banks, and in a more general sense, how regulatory changes (and even perceived changes) impact firm value.