How Effective Are Foreign Currency Futures Markets As Hedging Vehicles?

DOI:

https://doi.org/10.58886/jfi.v10i1.2316Abstract

In this paper, we investigate minimum risk hedges and hedging effectiveness measures for five currencies: Euro, Japanese yen, British pound, Swiss franc, and Canadian dollar. Analysis indicates the relative desirability of positions in futures contracts to minimize the risk of spot currency exposure. Among five currencies studied, Japanese yen proves the least hedging effectiveness across the time periods. Results also show hedging effectiveness increases with the investment horizon.

Downloads

Published

2012-06-30

How to Cite

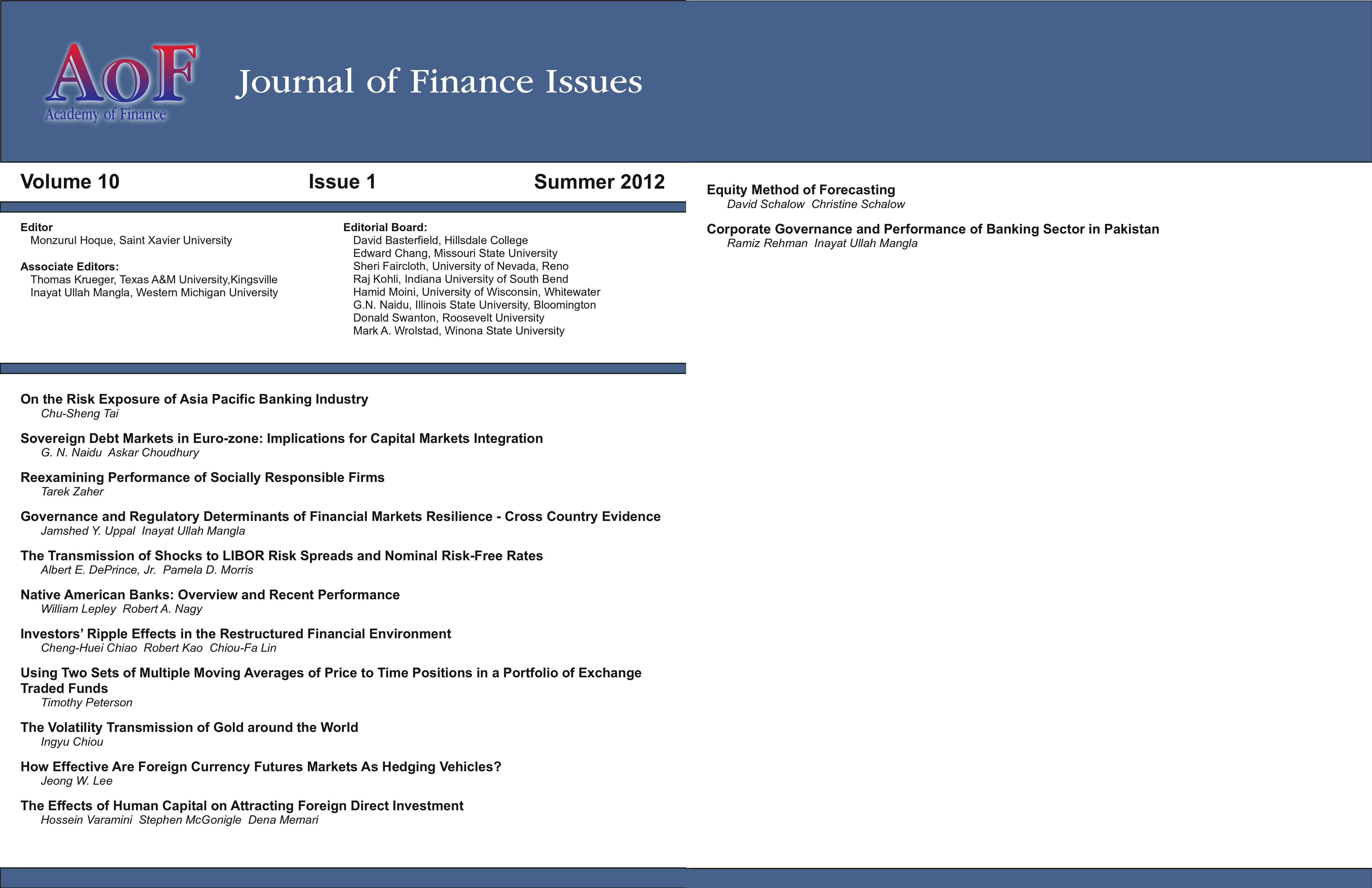

Lee, Jeong. 2012. “How Effective Are Foreign Currency Futures Markets As Hedging Vehicles?”. Journal of Finance Issues 10 (1):108-13. https://doi.org/10.58886/jfi.v10i1.2316.

Issue

Section

Original Article