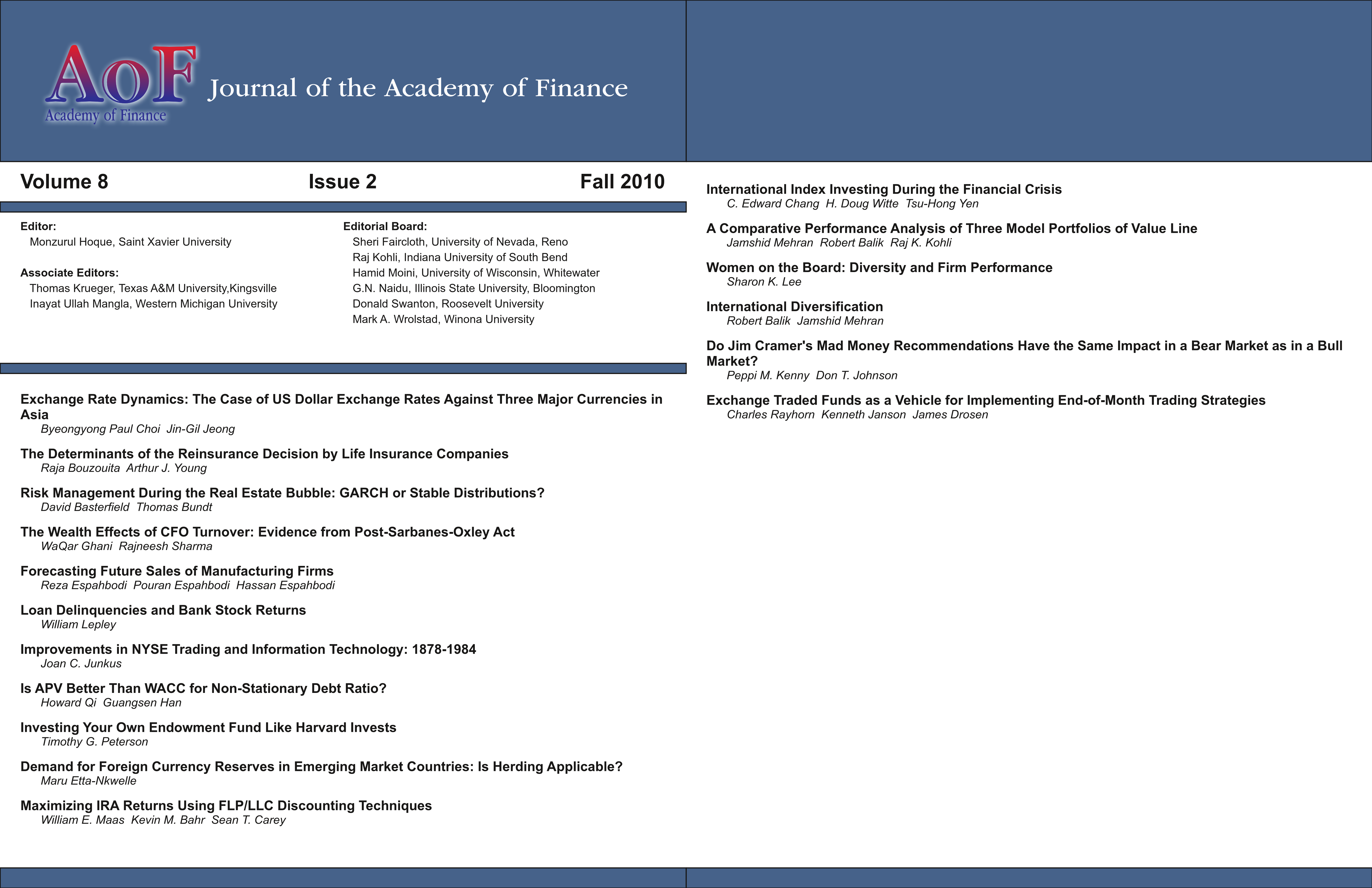

Do Jim Cramer’s Mad Money Recommendations Have the Same Impact in a Bear Market as in a Bull Market?

DOI:

https://doi.org/10.58886/jfi.v8i2.2328Abstract

Many empirical studies of investment advisory services find statistically significant abnormal returns at the time of their public availability. Jim Cramer’s Mad Money recommendations are one example of investment advice that has been studied in the recent past. This study is an extension of Neumann and Kenny’s (2007) work published earlier concerning Jim Cramer’s Mad Money stock picks. Earlier Neumann and Kenny (2007) found market reactions to Jim Cramer’s stock recommendations using 2005 data. In this study, Jim Cramer’s recommendations are examined again but utilizing more recent data occurring during a bear market rather than the previous examinations during bull markets. Specifically, this research questions whether viewers continue to follow Jim Cramer’s Mad Money stock suggestions in a bear market and whether the mentioned stocks still experience significant abnormal returns during part of the bear market of 2008. The analysis of stock returns and trading volume reveals statistical evidence of response to his buy recommendations.