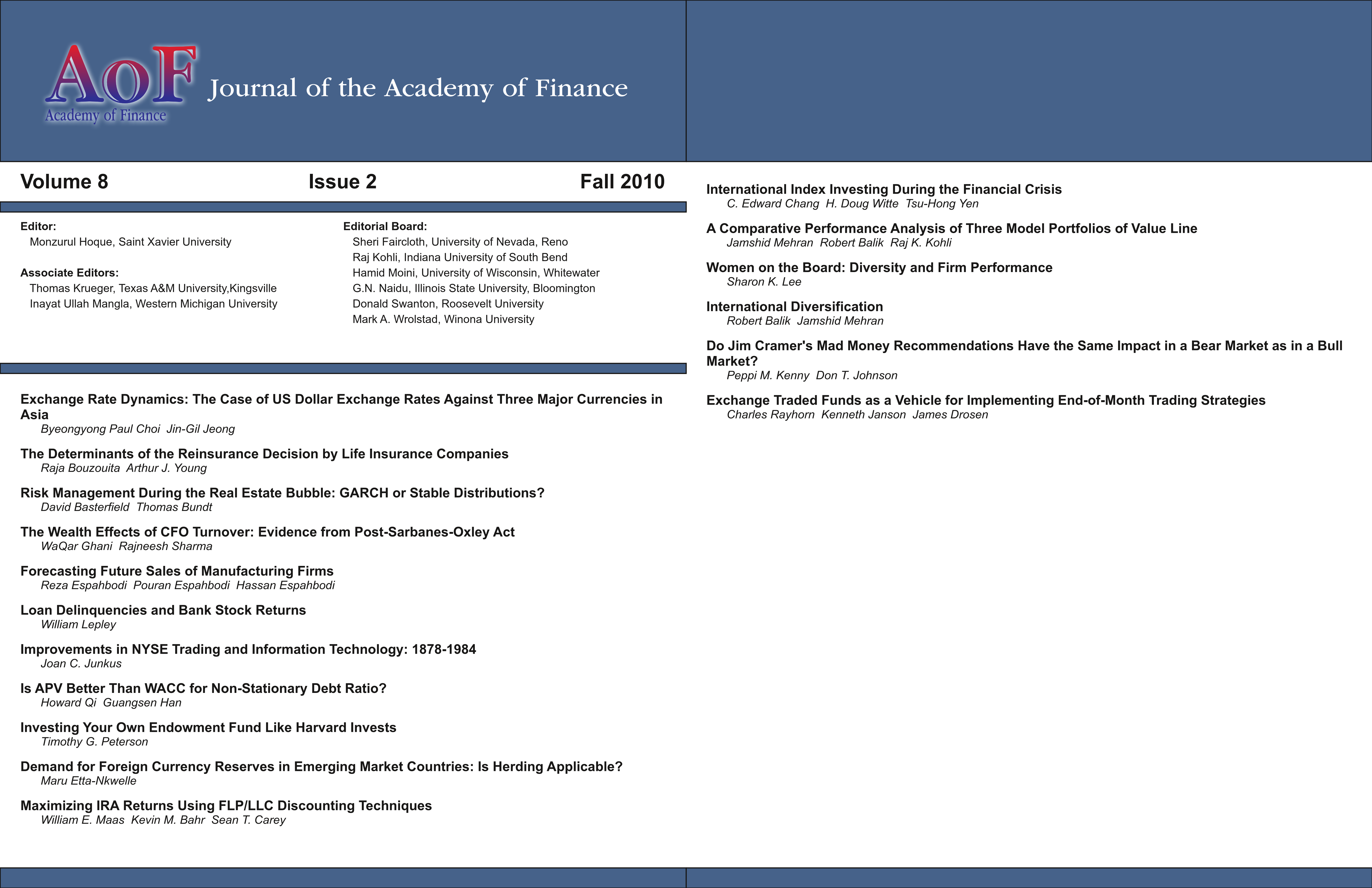

International Index Investing During the Financial Crisis

DOI:

https://doi.org/10.58886/jfi.v8i2.2332Abstract

Conventional wisdom suggests that active portfolio management should be beneficial in international markets, given the relative inefficiency of these markets compared to the U.S. market. Also, recent empirical evidence for U.S. mutual funds suggests that active portfolio management beats indexing during bear markets. Whether this result holds for international mutual funds is an open question. The performance of international mutual funds over the last 15 years as well as during the financial crisis of 2007-2009 offers the most recent timeframes in which to examine these two issues. We compare the performance of international index funds relative to all U.S.-based international mutual funds. Our results show that international index funds, including both index mutual funds and exchange-traded funds, appear to provide higher returns and similar risk when compared with category averages and thus most actively managed international mutual funds. These results hold over the 2007-2009 timeframe as well as over the past 15 years.