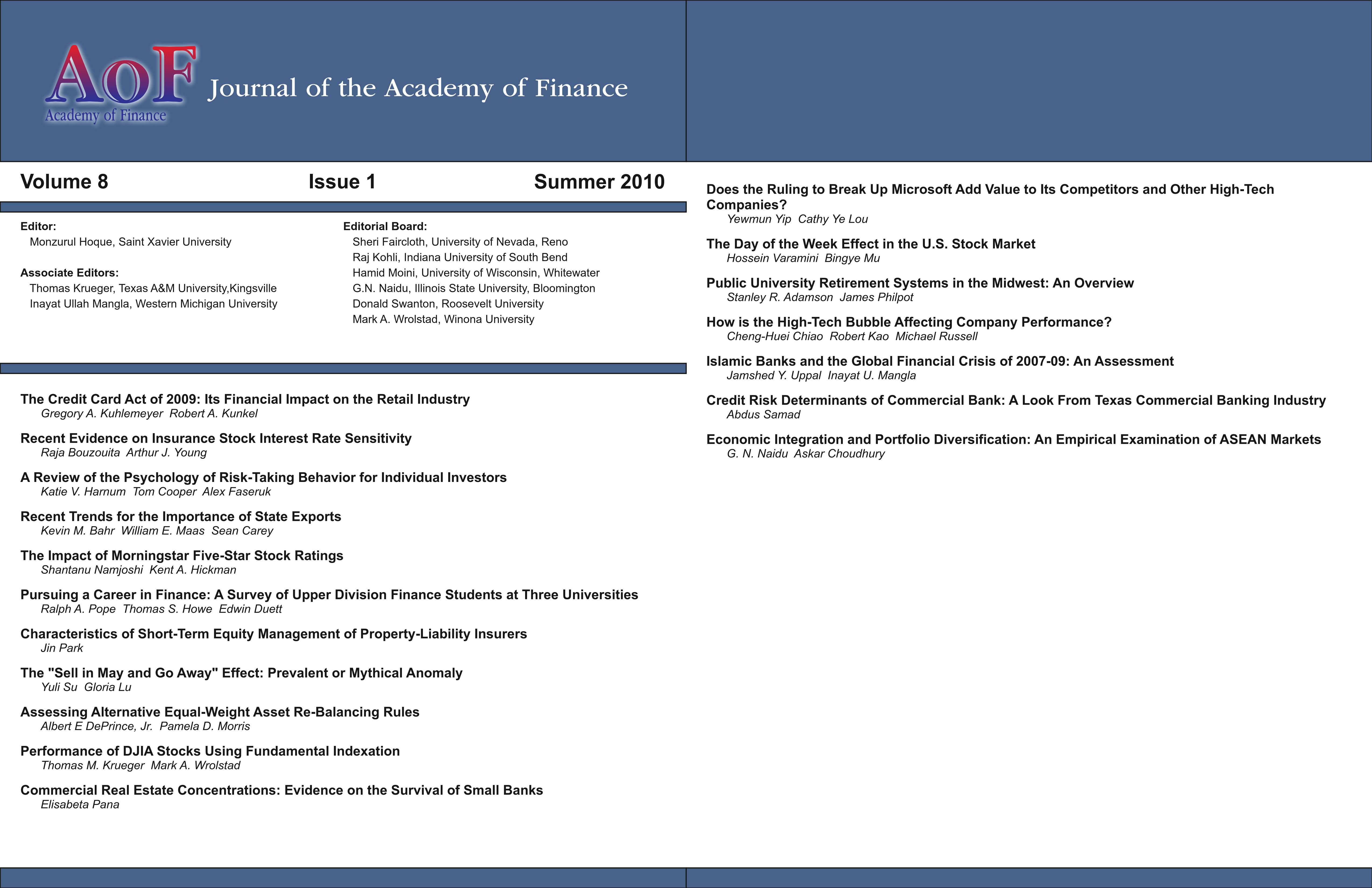

Economic Integration and Portfolio Diversification: An Empirical Examination of ASEAN Markets

DOI:

https://doi.org/10.58886/jfi.v8i1.2348Abstract

In this paper, we examine the potential gain achievable through international diversification using two different approaches to portfolio construction. We build portfolios in the Association of Southeast Asian Nations (ASEAN) stock markets for Japanese, German, and British investors respectively. Two sets of portfolios are constructed using two different approaches: a) Correlation based approach and b) Country Beta based approach proposed by Naidu and Choudhury (2006). Overall, our results show that Naidu-Choudhury approach (country-beta based) is a comparable alternative to Markowitz approach (correlation based) for all the three investors based on Sharpe’s performance measure for the time period considered. Moreover, our results indicate that Naidu-Choudhury approach holds a promise as an alternative method to create internationally diversified portfolios.