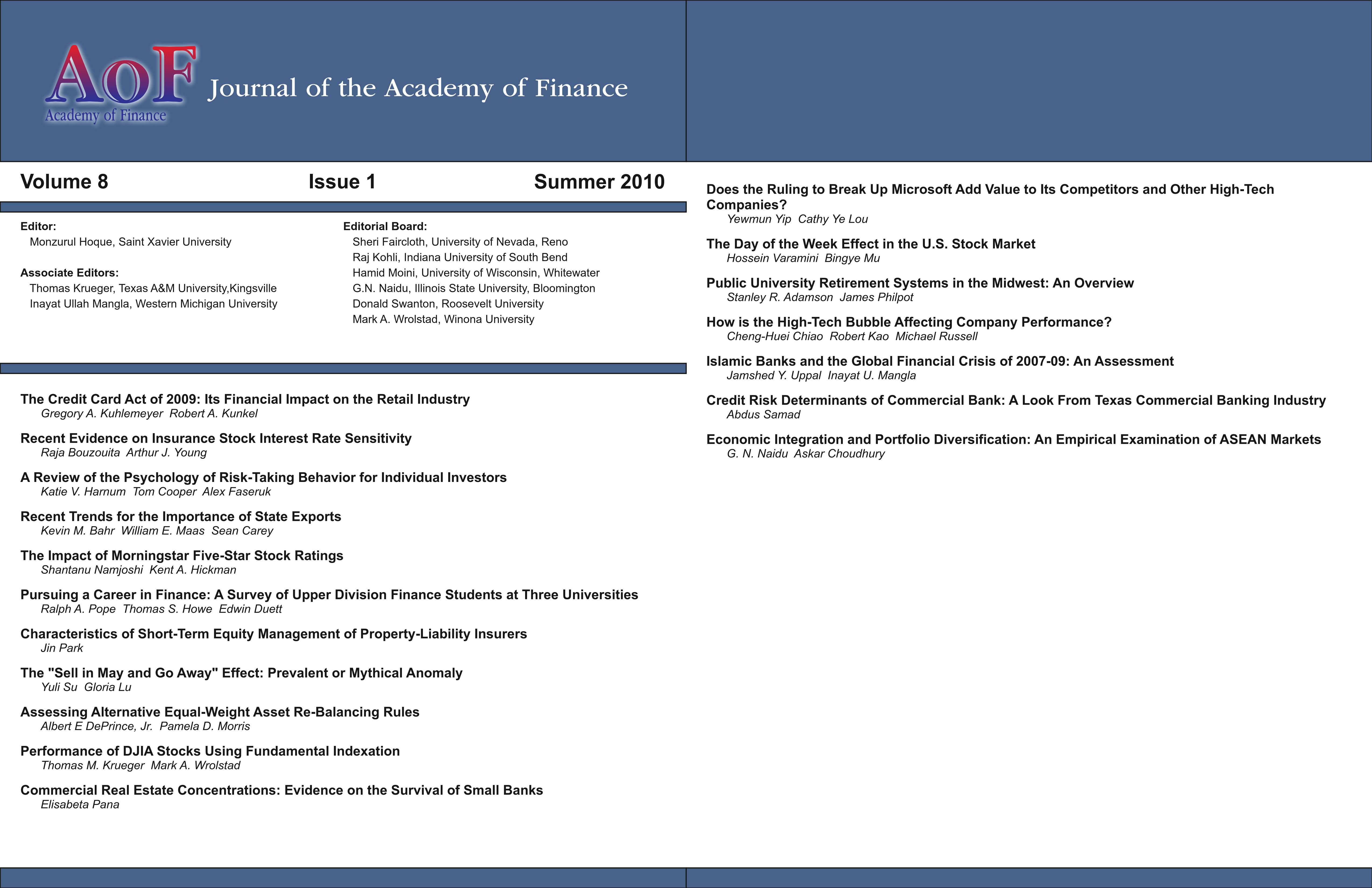

The Day of the Week Effect in the U.S. Stock Market

DOI:

https://doi.org/10.58886/jfi.v8i1.2353Abstract

This paper tests the efficiency of the U.S. stock market by examining the day-of-theweek effect for the average daily returns of the S&P 500 Index for a recent sample period and during the financial meltdown of 2008. The result of the pair-wise comparison of equal means show that the t-values for all pairs of daily returns are insignificant. The study then uses dummy variables to examine the day-of-the-week effect of the stock market by testing for equality of the mean returns across all trading days of the week. The empirical results of the study show that the individual t-values for the dummy variables and the F-value are insignificant for both time periods, signifying the absence of the day-of-the-week effect. The study concludes that there are no statistical differences among the daily returns of the S&P 500 Index for recent sample periods and provides additional support for the efficient market hypothesis.