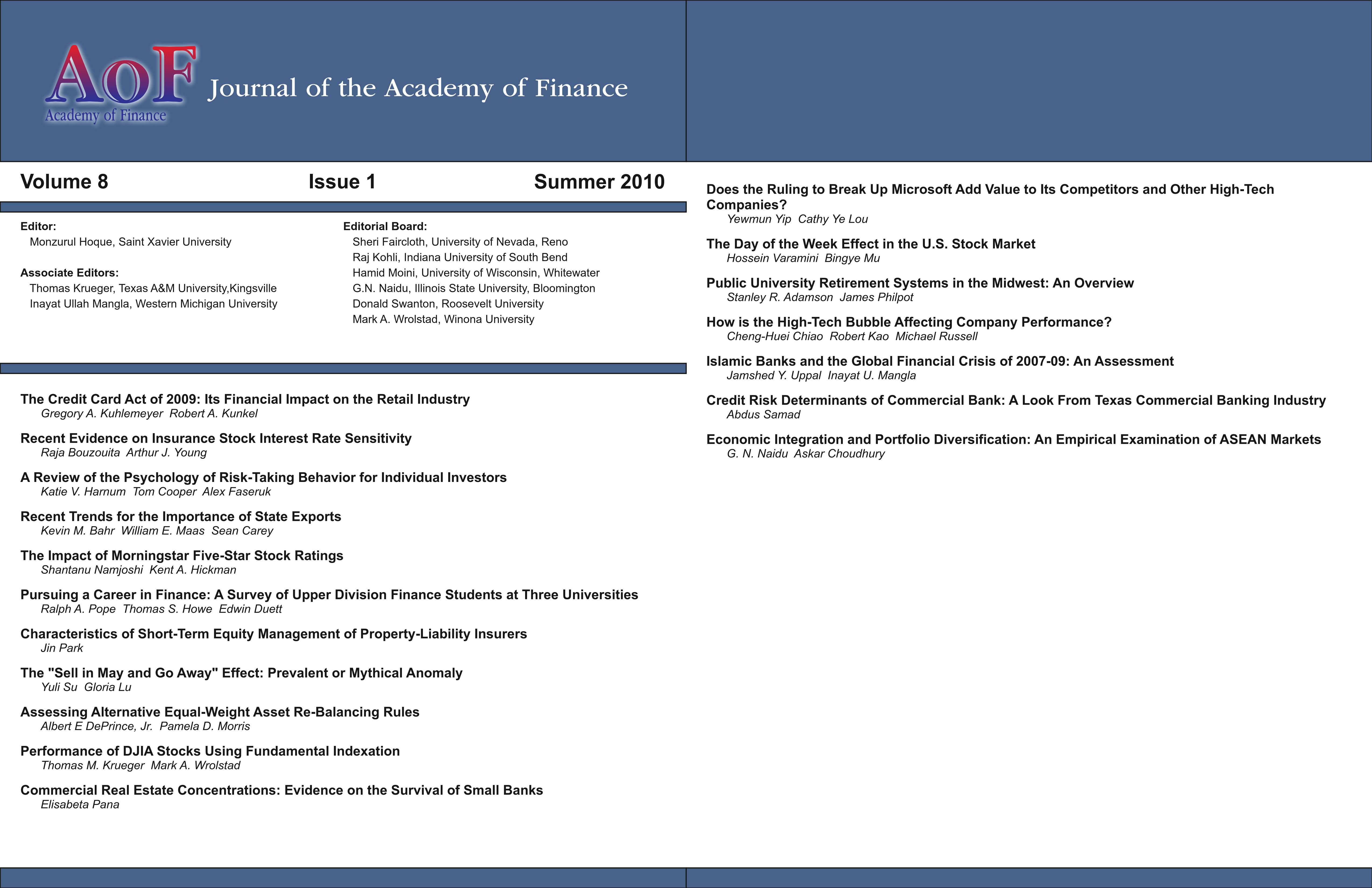

Performance of DJIA Stocks Using Fundamental Indexation

DOI:

https://doi.org/10.58886/jfi.v8i1.2356Abstract

During the decade beginning on December 31, 1999, an equal-weighted portfolio of the Dow Jones Industrial Average (DJIA) stocks outperformed the market capitalization and priceweighted portfolios, with ending values of $1,020, $731, and $777 on the $1,000 originally invested, respectively. The net income and free cash flows-weighted portfolios performed the best with identical ending values of $1,082. The portfolio with the lowest standard deviation measure of total risk was weighted on net income (14.26%) and the portfolio with the highest total risk was weighted on total assets (27.78%). All portfolios had their worst performance in 2008, while the best performance varied across portfolios but were limited to the years 2003, 2006 and 2009.