Detection of Multiple Beta Shifts in Mutual Fund Returns Data

DOI:

https://doi.org/10.58886/jfi.v6i2.2397Abstract

Research suggests that mutual fund betas are not stationary. However, the performance of the nonstationarity tests has been called into question. This study examines the ability of four such tests. None of the tests shows good ability to detect sudden 25 percent beta shifts, and two of the tests have inflated, one of them grossly inflated, Type I error rates.

Downloads

Published

2008-12-31

How to Cite

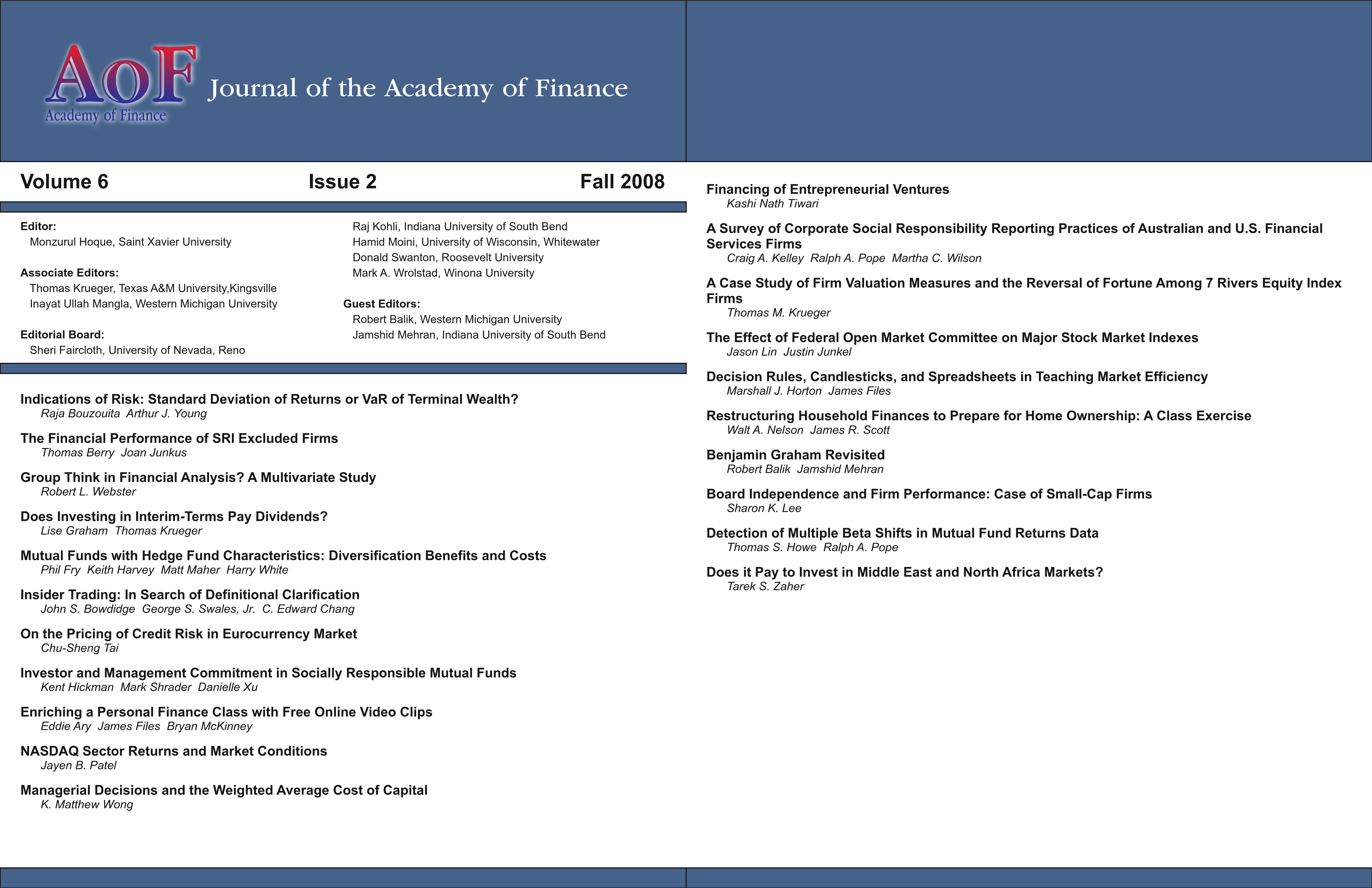

Howe, Thomas, and Ralph Pope. 2008. “Detection of Multiple Beta Shifts in Mutual Fund Returns Data”. Journal of Finance Issues 6 (2):196-211. https://doi.org/10.58886/jfi.v6i2.2397.

Issue

Section

Original Article