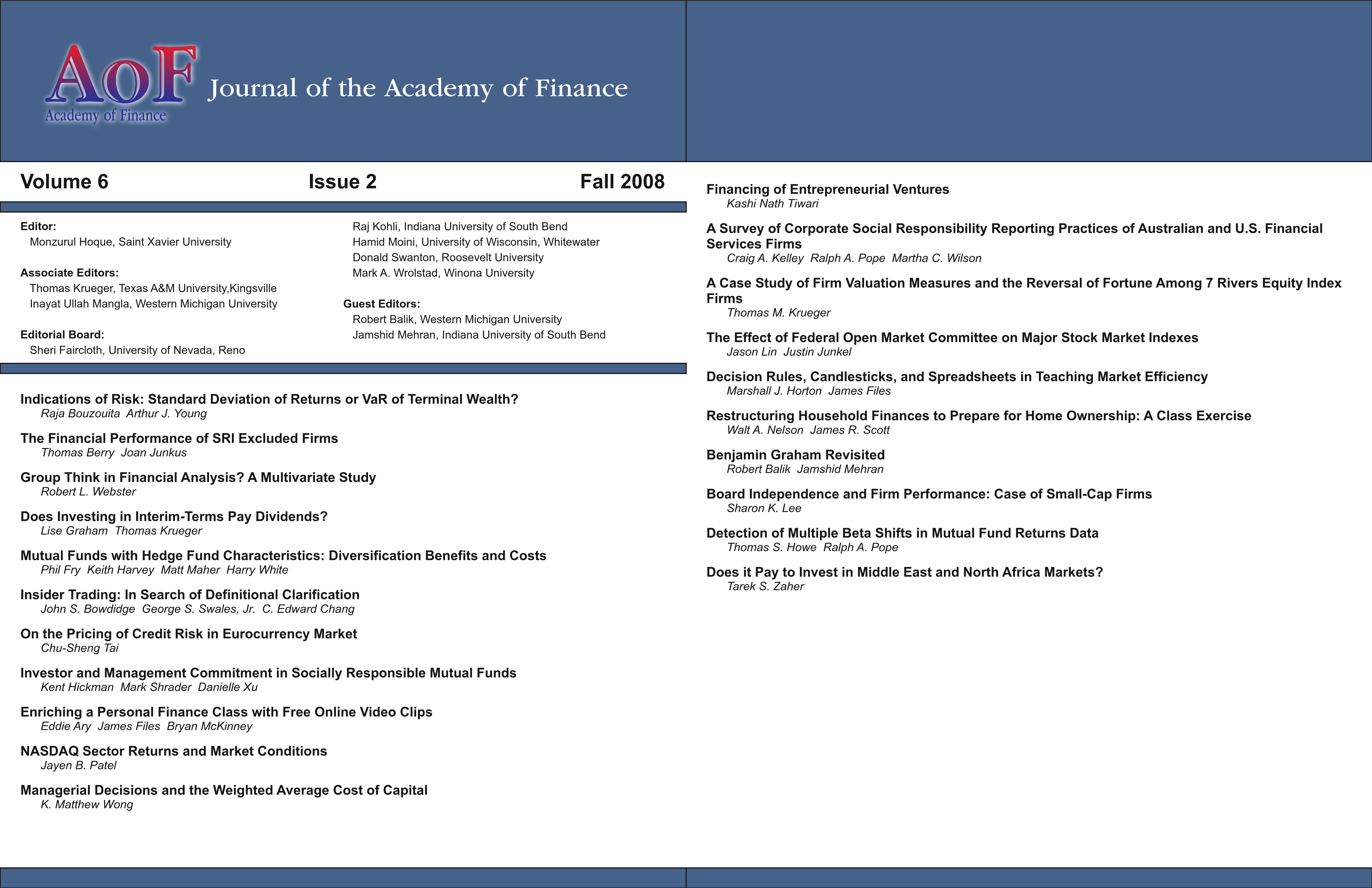

Decision Rules, Candlesticks, and Spreadsheets in Teaching Market Efficiency

DOI:

https://doi.org/10.58886/jfi.v6i2.2401Abstract

This paper shows how students can construct spreadsheets using publicly available data to test market efficiency in the weak sense using historical data. The results produced by this method indicate that the candlestick approach does not help in stock selection. In fact, any trading rule that can be expressed by a series of inequalities can be used with this approach, showing the student first hand that stocks are indeed efficient. The authors hope that investment instructors, who want students to see for themselves that markets tend to be efficient, will find utility in this method in the classroom.

Downloads

Published

2008-12-31

How to Cite

Horton, Marshall, and James Files. 2008. “Decision Rules, Candlesticks, and Spreadsheets in Teaching Market Efficiency”. Journal of Finance Issues 6 (2):150-72. https://doi.org/10.58886/jfi.v6i2.2401.

Issue

Section

Original Article