On the Pricing of Credit Risk in Eurocurrency Market

DOI:

https://doi.org/10.58886/jfi.v6i2.2410Abstract

Most of previous studies on credit risk have been focused on corporate bond markets. This paper focuses on whether the credit risk is priced in the Eurocurrency market. The empirical test relies on a multivariate GARCH (1,1)-in-mean version of the ICAPM model to describe the joint stochastic process of three state variables: world market risk, interest rate risk, and credit risk, during the period January 1986 to December 2002. The paper documents a negative, significant, and time-varying systematic credit risk premium.

Downloads

Published

2008-12-31

How to Cite

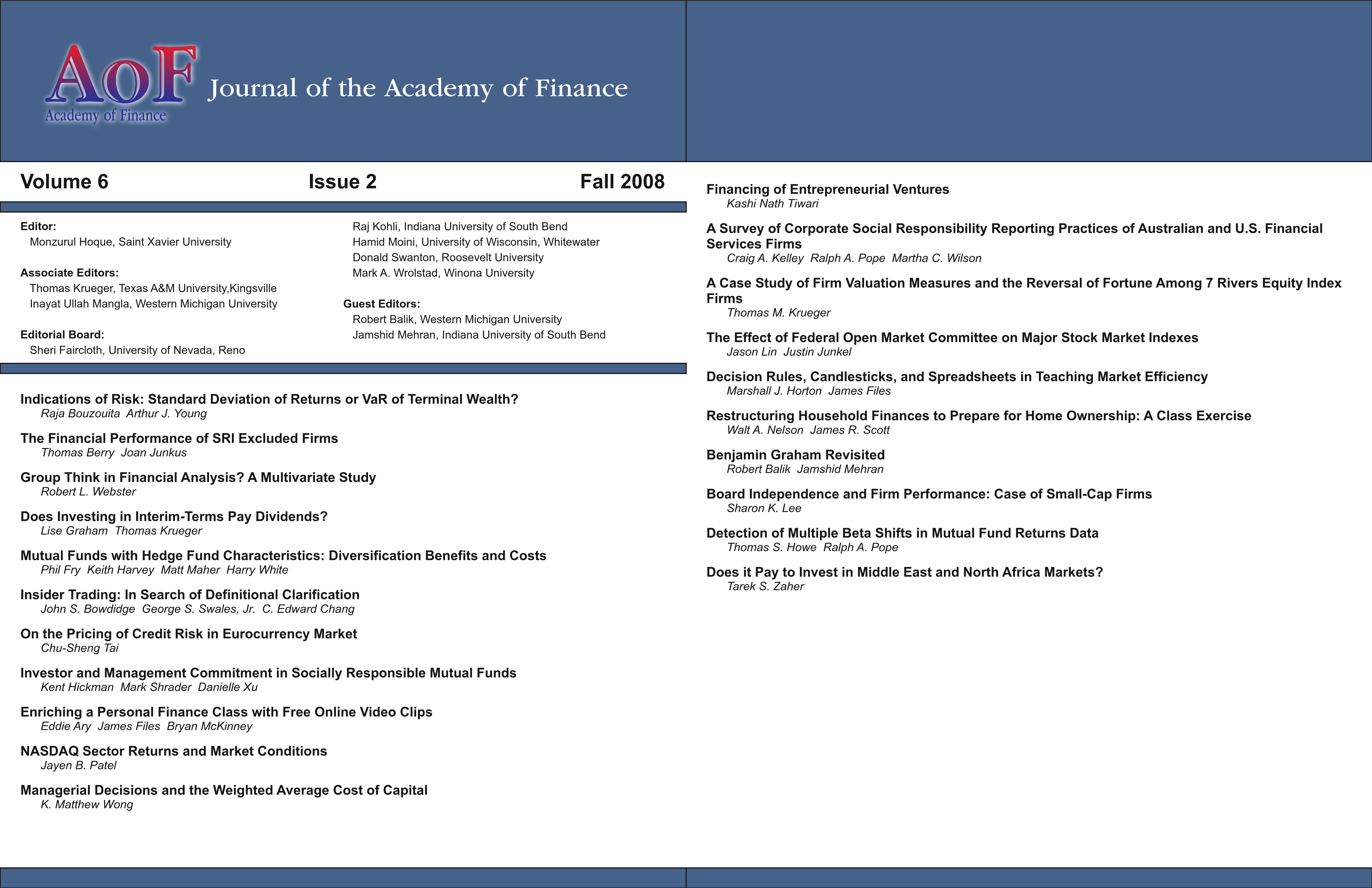

Tai, Chu-Sheng. 2008. “On the Pricing of Credit Risk in Eurocurrency Market”. Journal of Finance Issues 6 (2):54-63. https://doi.org/10.58886/jfi.v6i2.2410.

Issue

Section

Original Article