Mutual Funds with Hedge Fund Characteristics: Diversification Benefits and Costs

DOI:

https://doi.org/10.58886/jfi.v6i2.2412Abstract

Hedge funds claim higher returns with lower risk and low correlation with the U.S. stock market, albeit at a higher cost than alternative investments. This paper examines the corresponding properties of mutual funds that employ hedge fund type strategies. Results show that mutual funds in the Morningstar long-short category, compared to a matched mutual fund samples, have slightly lower total returns but higher risk-adjusted performance measures based on lower risk statistics. Lower beta and R2 for the long-short funds highlight their main benefit as a portfolio diversifier. Expense ratio and turnover costs are higher for long-short funds.

Downloads

Published

2008-12-31

How to Cite

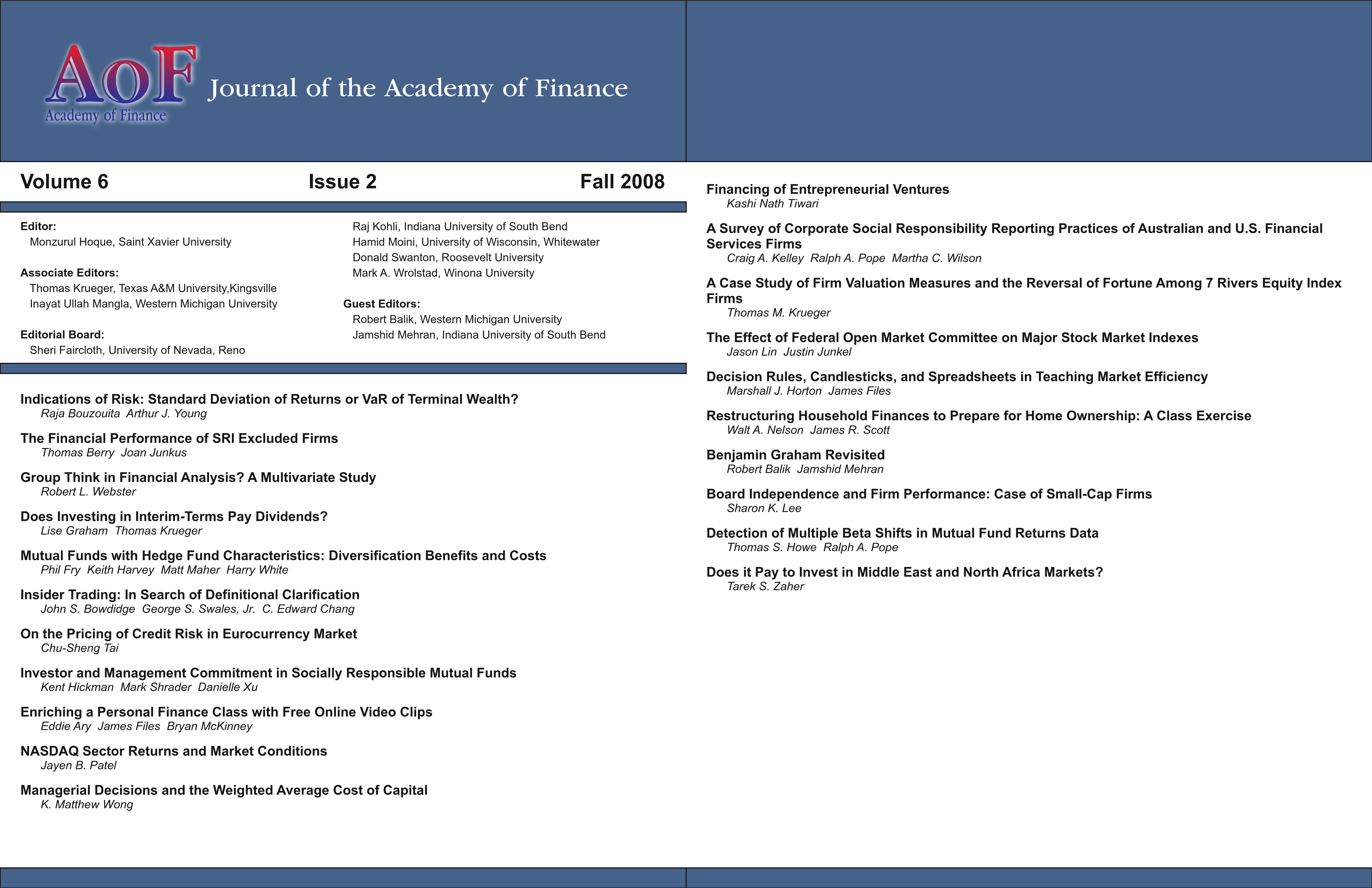

Fry, Phil, Keith Harvey, Matt Maher, and Harry White. 2008. “Mutual Funds With Hedge Fund Characteristics: Diversification Benefits and Costs”. Journal of Finance Issues 6 (2):35-44. https://doi.org/10.58886/jfi.v6i2.2412.

Issue

Section

Original Article