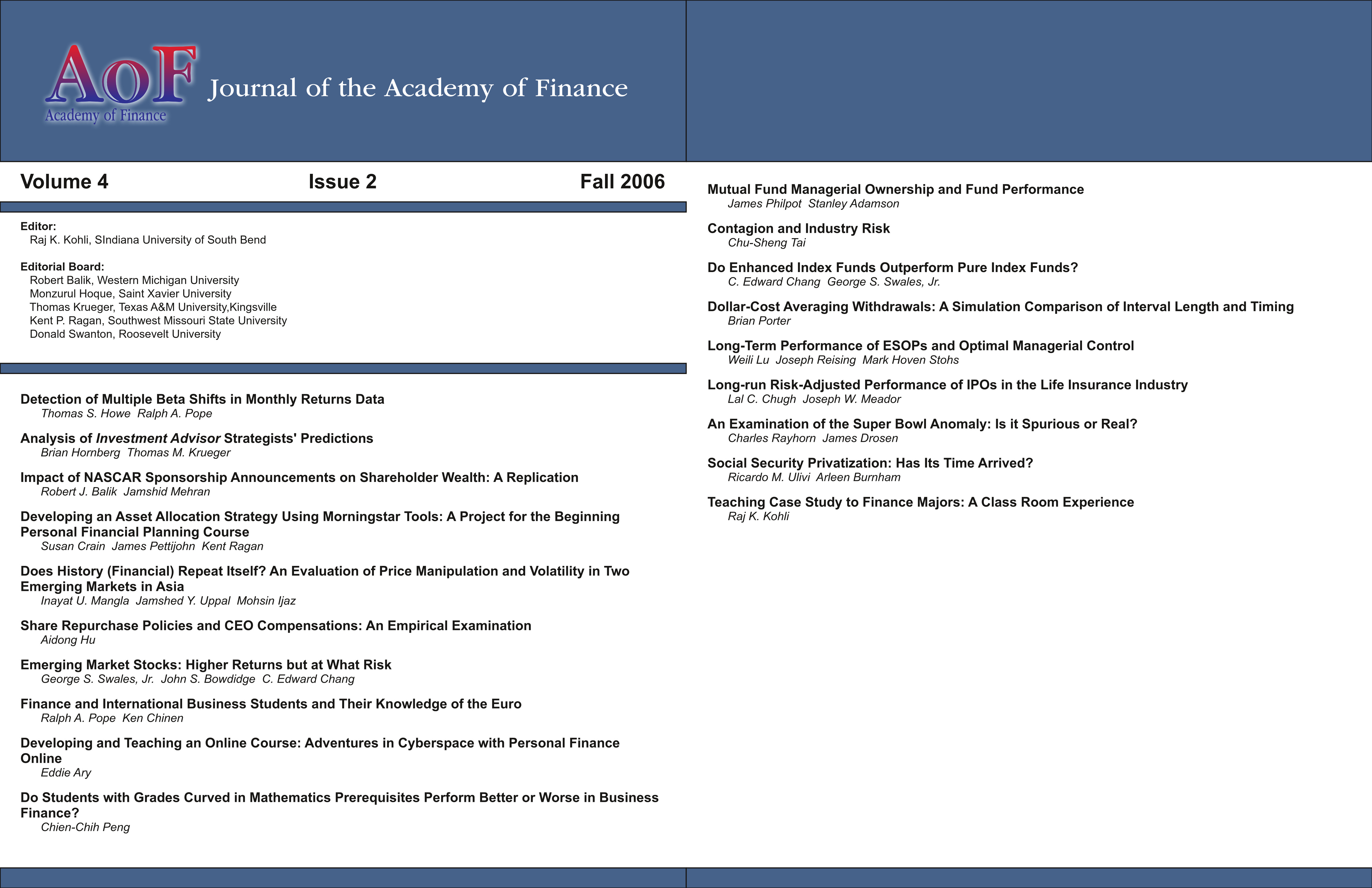

Dollar-Cost Averaging Withdrawals: A Simulation Comparison of Interval Length and Timing

DOI:

https://doi.org/10.58886/jfi.v4i2.2441Abstract

Dollar-cost averaging (DCA) is a common investment technique. The premise being, by investing a fixed amount in a given security over equal periodic intervals, one will buy more shares when the price of the security is low, and less shares when the price is high. To its advantage, DCA's instinctive purchasing of more shares when the price of a security is low, partially fulfills the cliche investing advice, buy low and sell high. Because the average price of the cumulative shares purchased with DCA will always be less than the average price of the security over the same period of time (Whitehead, 1999), DCA can reduce an investor's risk (Malkiel, 2004). Given its proven results, and simplicity to execute, DCA is a popular technique for buying investments, often touted by investment companies (e.g., Fidelity Investments) and investment gurus (e.g., Jane Bryant Quinn and the Motley Fools). This study fills the gap that currently exists in this area of research and advances this body of knowledge in three important ways. One, it examines DCA, a technique for building wealth, and applies it to the withdrawal of funds. Two, it compares two controllable factors for DCA withdrawals, interval length and timing afwithdrawals. Three, it uses recent data that are comprehensive of the overall market. Results of this study indicate that both interval length andtiming of withdrawals impact the performance of DCA as a withdrawal strategy. It is also found that, contrary to intuitive thinking, the performance of DCA is relatively good.