Firm Size, Profitability, and Growth: A Dynamic Panel Analysis of the U.S. Life Insurance Industry

DOI:

https://doi.org/10.58886/jfi.v17i2.2456Abstract

This paper analyzes the relationship between growth and firm size in the U.S. life insurance industry. Applying a dynamic panel model to a sample of life insurance companies from 1993 to 2010, I find strong support for the law of proportional effect (LPE). The results indicate that there is persistency in the growth of life insurance companies. Moreover, the findings suggest that firm specific characteristics such as age, profitability and leverage explain the size of insurance companies and macroeconomic covariates such as growth in GDP and the real interest rate are significant determinants.

Downloads

Published

2018-12-31

How to Cite

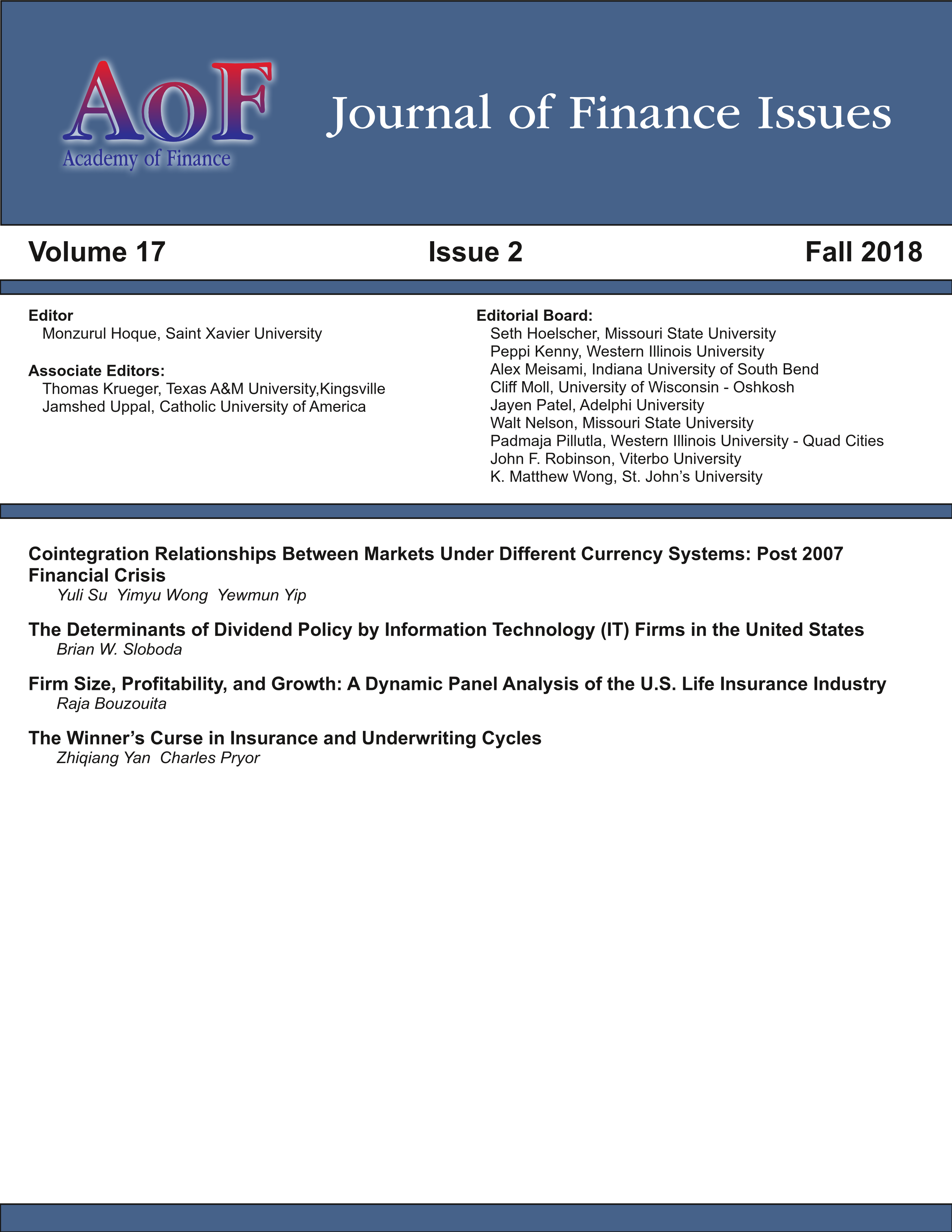

Bouzouita, Raja. 2018. “Firm Size, Profitability, and Growth: A Dynamic Panel Analysis of the U.S. Life Insurance Industry”. Journal of Finance Issues 17 (2):34-43. https://doi.org/10.58886/jfi.v17i2.2456.

Issue

Section

Original Article