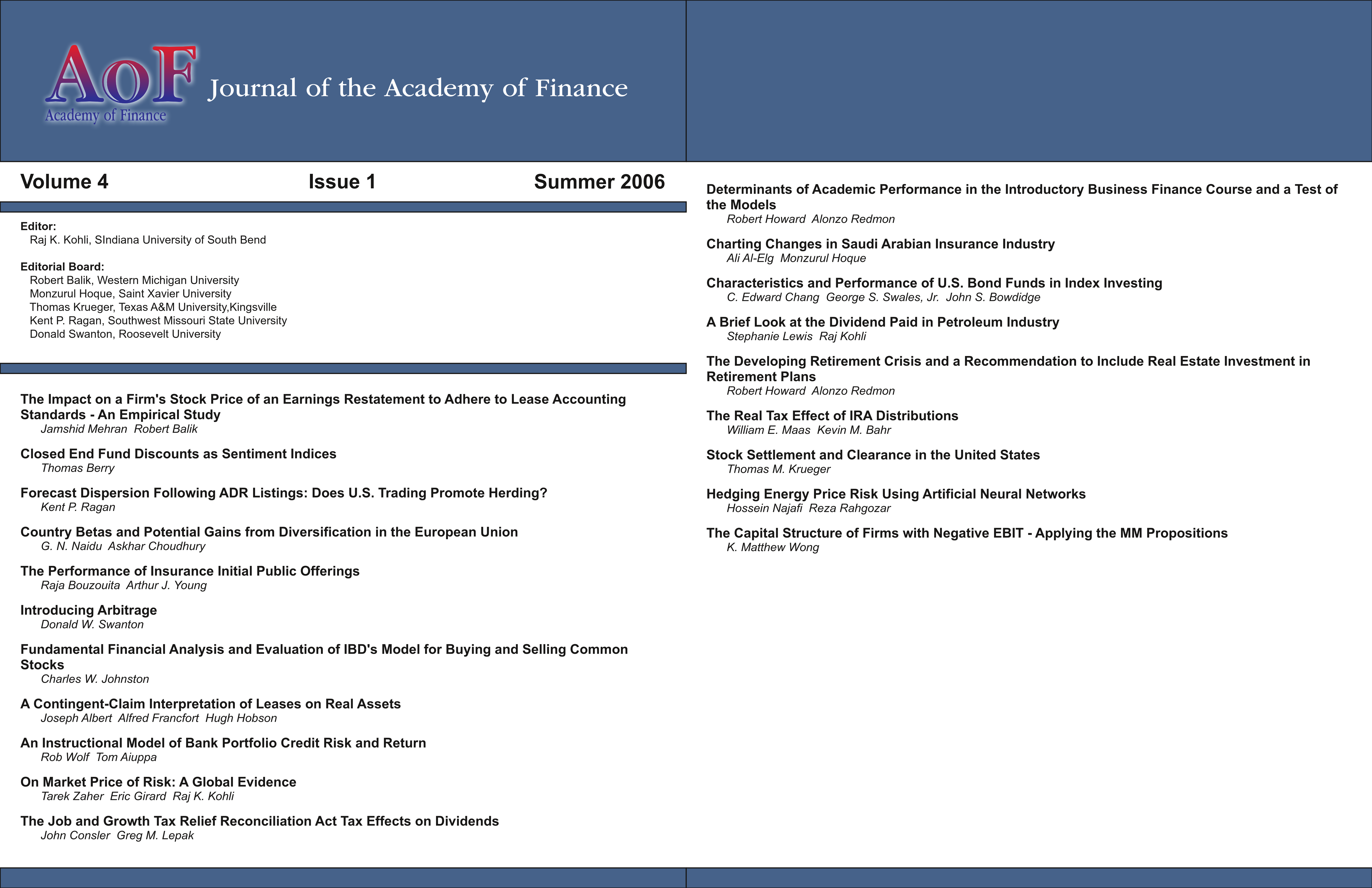

Hedging Energy Price Risk Using Artificial Neural Networks

DOI:

https://doi.org/10.58886/jfi.v4i1.2460Abstract

This paper provides an empirical study of the effectiveness of hedging energy prices using a neural network model. The hedging effectiveness of the model is investigated using daily crude oil, natural gas, and unleaded gasoline futures prices. Empirical results show that the neural network hedging model is effective in reducing commodity price risks.

Downloads

Published

2006-06-30

How to Cite

Najafi, Hossein, and Reza Rahgozar. 2006. “Hedging Energy Price Risk Using Artificial Neural Networks”. Journal of Finance Issues 4 (1):180-89. https://doi.org/10.58886/jfi.v4i1.2460.

Issue

Section

Original Article