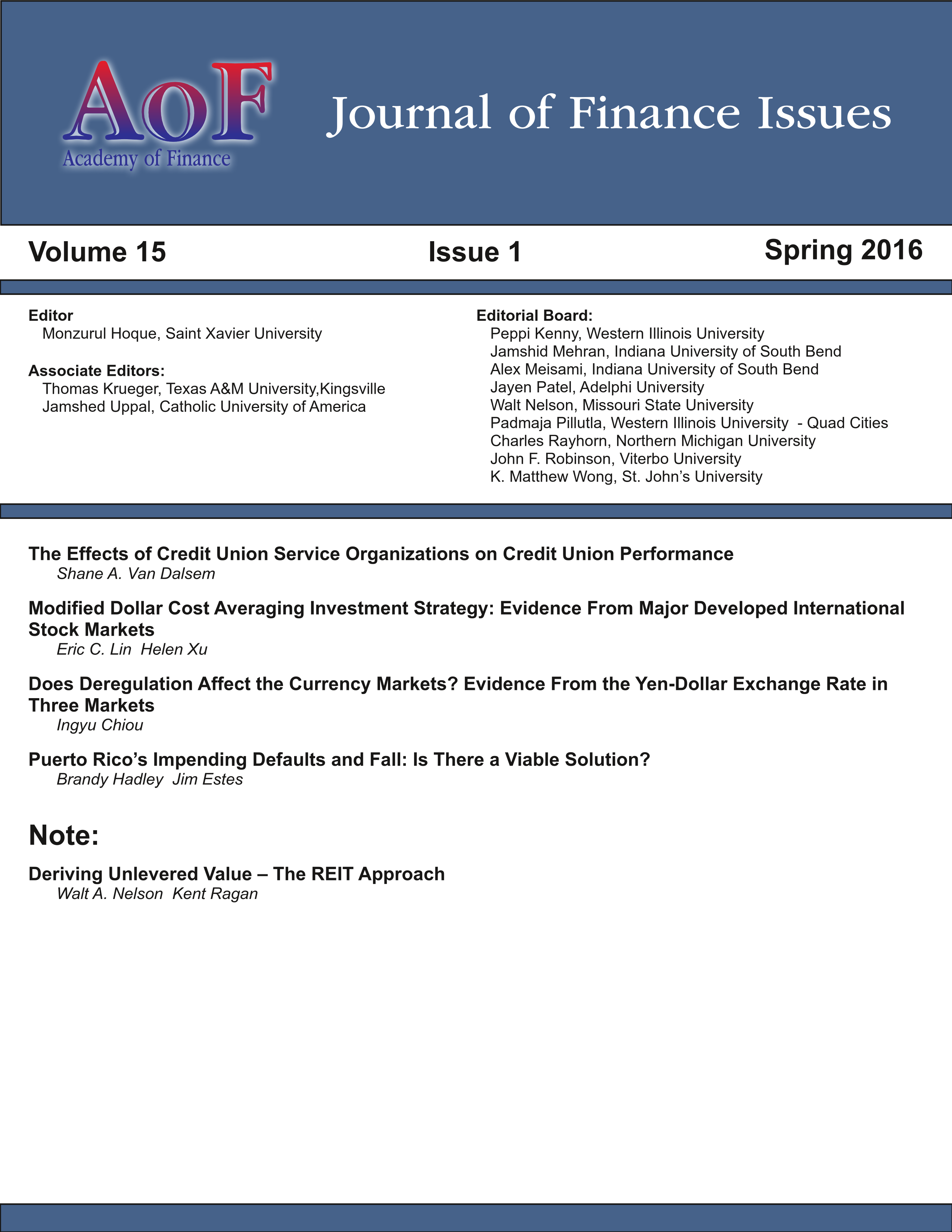

Deriving Unlevered Value – The REIT Approach

DOI:

https://doi.org/10.58886/jfi.v15i1.2486Abstract

This article demonstrates the application of the Modigliani and Miller valuation model to privately-held non-taxable real estate entities, such as real estate investment trusts (REITs). The International Financial Reporting Standards Foundation has recently published IFRS 13, which requires periodic valuation of privately held and publically held assets.

Downloads

Published

2016-06-30

How to Cite

Nelson, Walt, and Kent Ragan. 2016. “Deriving Unlevered Value – The REIT Approach”. Journal of Finance Issues 15 (1):59-63. https://doi.org/10.58886/jfi.v15i1.2486.

Issue

Section

Notes