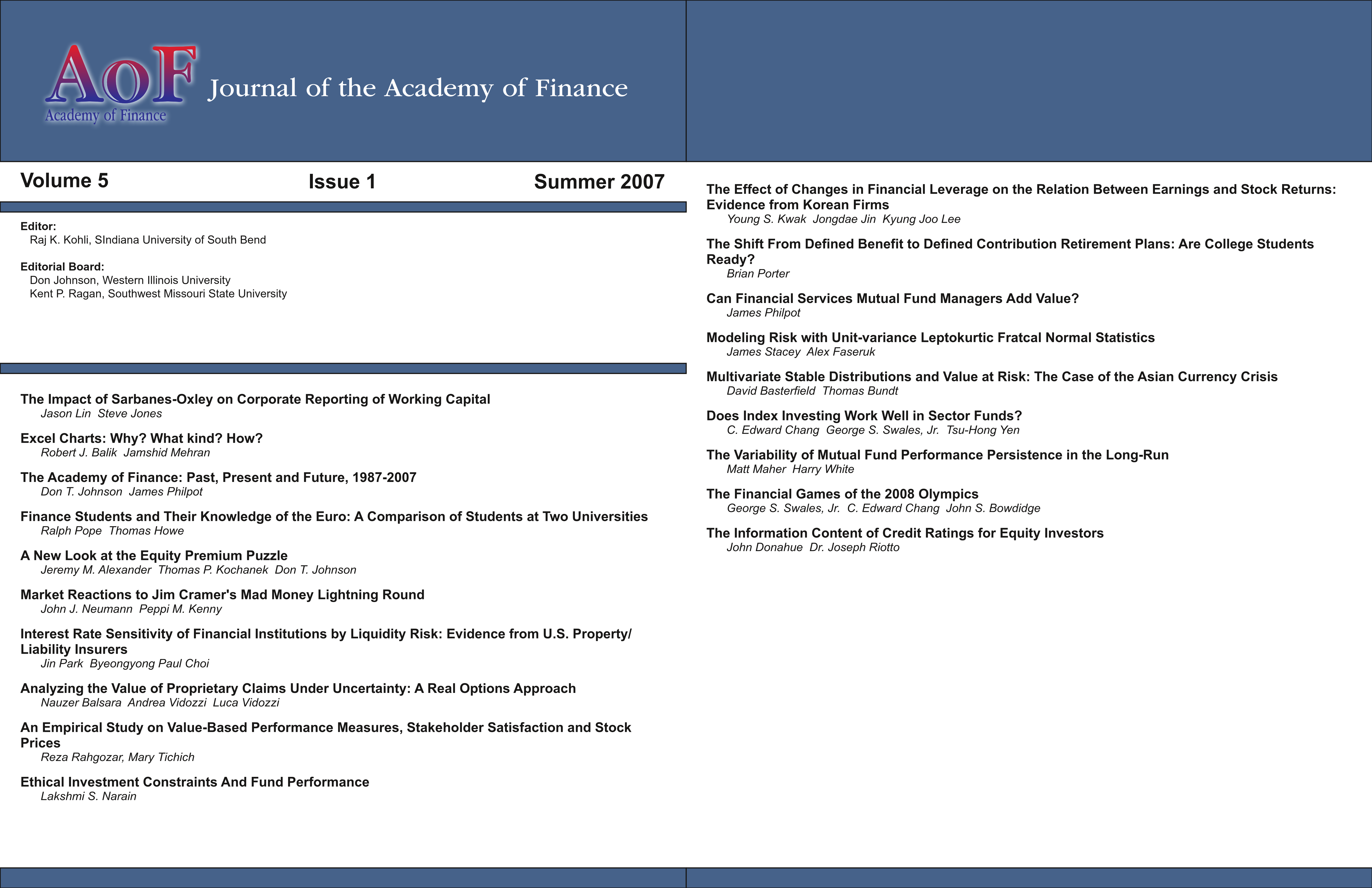

Can Financial Services Mutual Fund Managers Add Value?

DOI:

https://doi.org/10.58886/jfi.v5i1.2596Abstract

Prior research suggests that mutual fund managers operating in specific sectors may be able to take advantage of "pockets of inefficiency" and thus produce positive abnormal returns. examine the performance of financial sector mutual funds over the time period 2002-2005, which was a unique market for financial services marked by low interest rates, strong mortgage loan demand and completion of several rounds of bank deregulation. During this time period, financial sector indices outperformed general market indices. Financial fund managers on average produced positive abnormal returns as measured using both a single-and multi-factor returns model. In cross section, these abnormal returns are unrelated to fund size. There is marginal evidence that fund returns are inversely related to portfolio turnover rates and directly related to fund expense ratios.