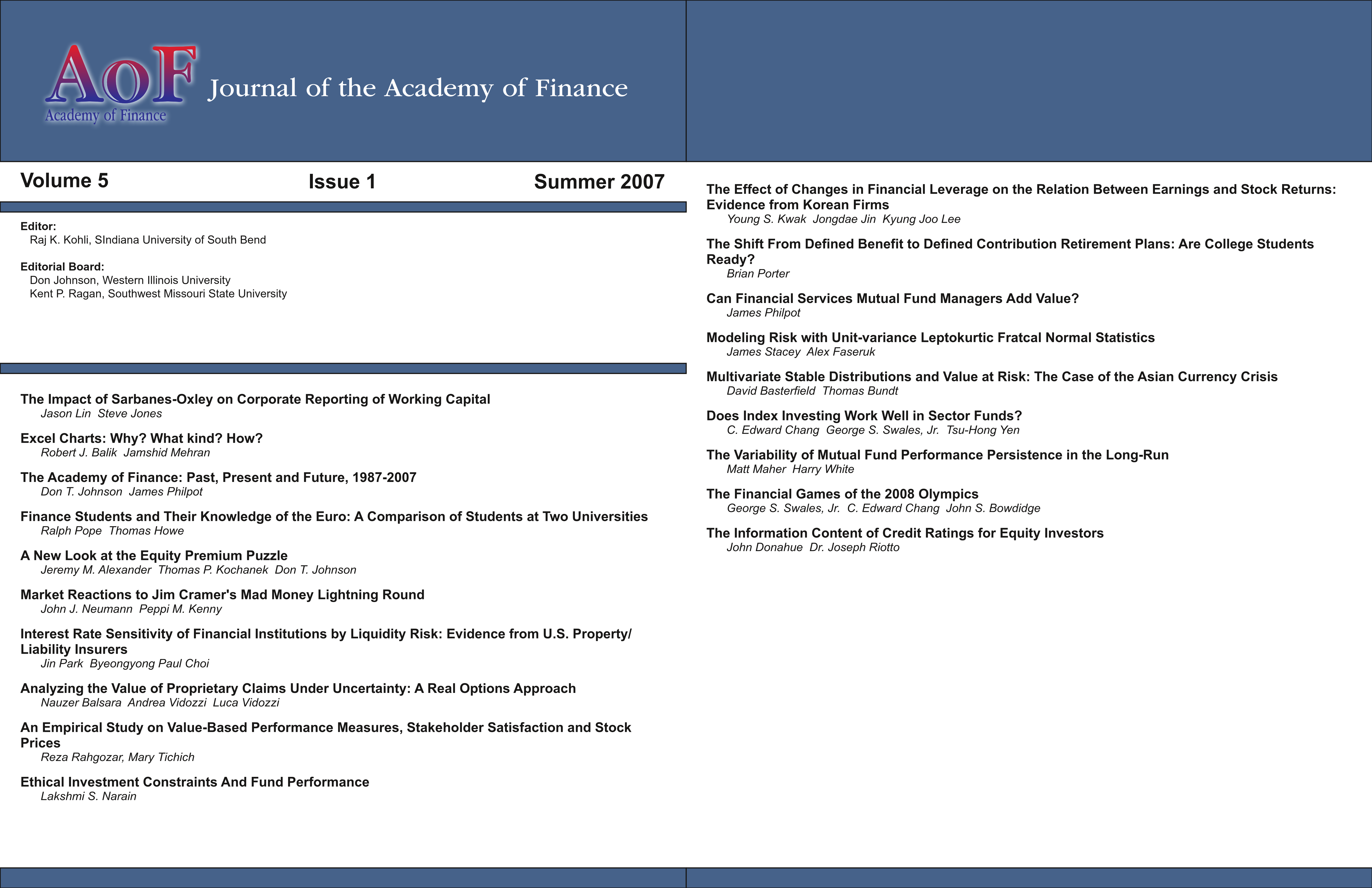

Modeling Risk with Unit-variance Leptokurtic Fratcal Normal Statistics

DOI:

https://doi.org/10.58886/jfi.v5i1.2600Abstract

This abstract was created post-production by the JFI Editorial Board.

This study examines the hypothesis that there exists a family of unit-variant leptokurtic probability density functions with the attractive properties of normal statistics. It constructs numerically a family of symmetric Normal pdfs defined for fractal spaces with index q. These distributions have the attractive property of having unit variance for 1 <q<2 and approximately unit variance for 0.5<q<1 (the limit of the range that was studied). This paper studies the conjecture that there exists a family of Normal distributions with unit variance that can be defined on metric spaces of dimension m=q/2 for 0<q<2. Some analytical techniques that arise from this conjecture are explored, indicating how one could apply a broader theory of fractal statistics in practice. The power of these techniques follows from the property that the scale of the numerically generated probability distributions is independent of the fractal index q. This allows the non-linearity of fractal statistics to be absorbed into a universal non-linear function of a shape measure with the kurtosis chosen to illustrate the method: for what this study calls Fractal Normal, or Formal, pdfs. It is found that the application of Fractal Normal statistics retains the attractiveness of Normal statistics by allowing optimal solutions to be determined in a straightforward fashion.