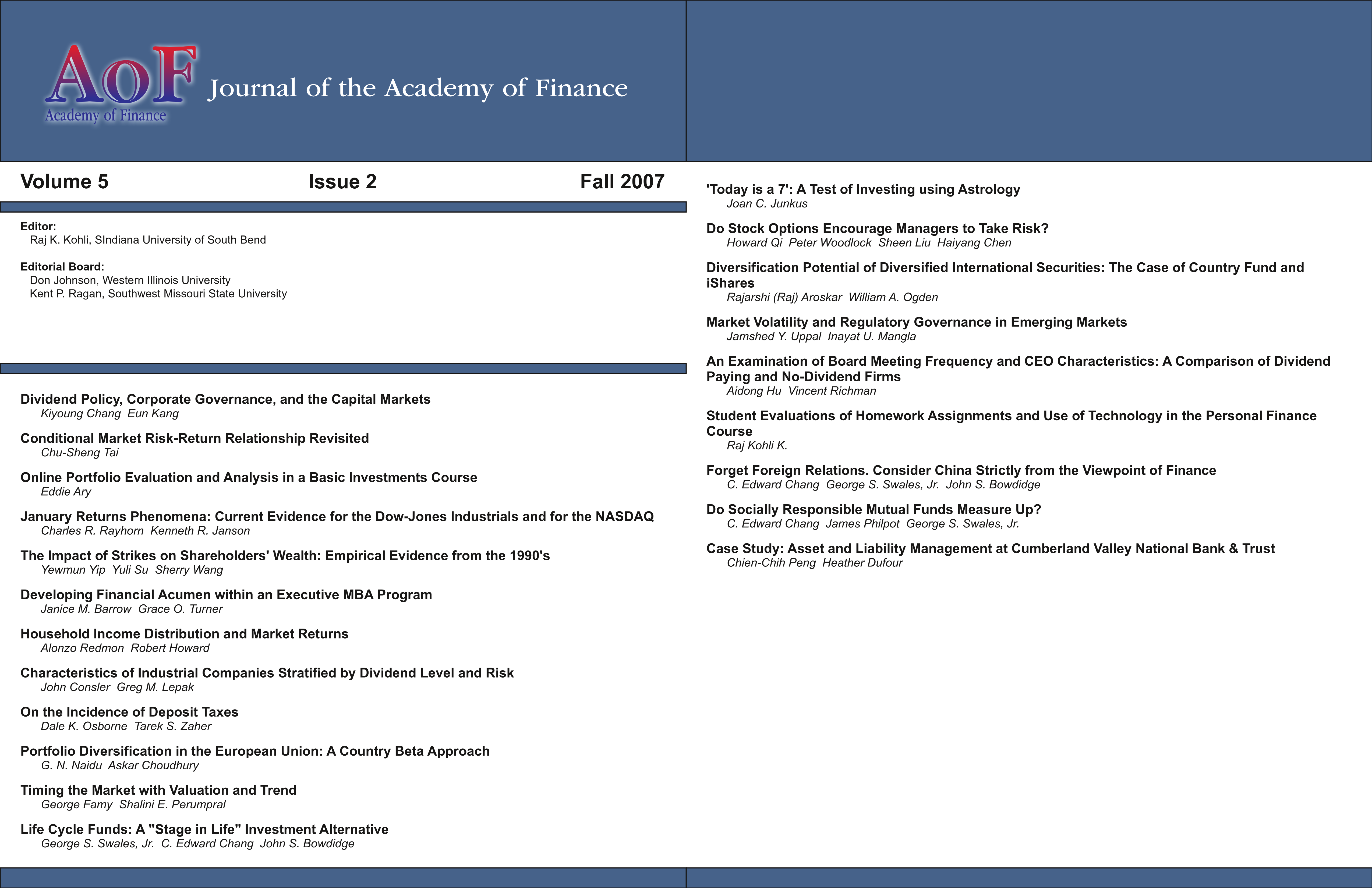

Diversification Potential of Diversified International Securities: The Case of Country Fund and iShares

DOI:

https://doi.org/10.58886/jfi.v5i2.2624Abstract

In this study, the country funds and iShares of Europe and Asia are used to study diversification potential in the markets of Europe and Asia. Any short-term lead/lag relationships in these asset prices and net asset values (NAVs) respectively are investigated. Results show that both European and Asian iShares affect their country fund counterparts. While such relationships are found only in prices for Europe, both NA V and price relationships are found in Asia. Reverse relationships from country funds to iShares are not found in either region. Hence, investor perceptions play a major role in information transmission in these markets. The presence of such relationships might lead to a reduction in diversification potential for investors.