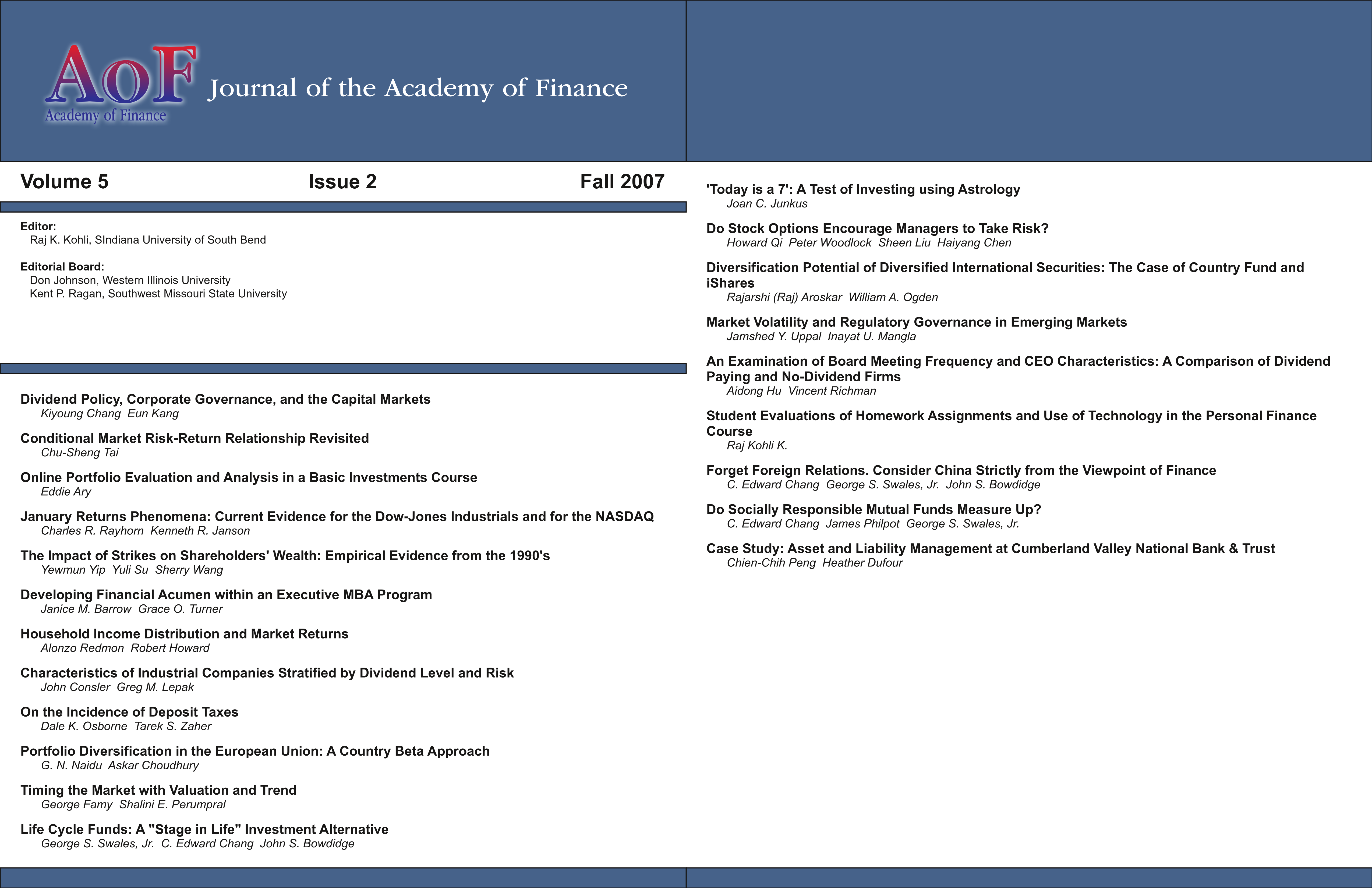

Case Study: Asset and Liability Management at Cumberland Valley National Bank & Trust

DOI:

https://doi.org/10.58886/jfi.v5i2.2630Abstract

Asset and liability management is the financial risk management practiced at financial institutions. The goal of asset and liability management is to maximize the risk-adjusted returns to shareholders over the long run. Credit risk is a very important risk category in banking because bankers usually manage credit risk on daily basis. How credit administration and asset and liability management should be coordinated to insure proper returns to shareholders is a critical issue to examine. This issue involves both the loan origination process and loan portfolio diversification. The loan origination process establishes policies and procedures to guide lenders within a banking atmosphere. These policies and procedures outline the type of loans and borrowers a bank wants to attract and those loans and borrowers a bank wants to avoid. Also among these guidelines are checks and balances to ensure compliance and accuracy. Loan portfolio diversification is important for the financial welfare of banks and for stability purposes. The goal of this paper is to identify how poor loan origination processes and poorly managed loan portfolios can negatively affect bank performance. The impact of such negative implications can result in configurations that stray from the norm, or peer group average. This paper also looks at one bank that recognized their difficulties and the actions they took to turn their company around.