The Impact of Post-Trade Transparency on Investors: Evidence from an Emerging Market

DOI:

https://doi.org/10.58886/jfi.v20i2.3762Keywords:

post-trade transparency, information asymmetry, realized spread, payoffAbstract

This study examines the effects of a post-trade transparency event on the payoff to informed and uninformed traders of large and small size firms. The evidence indicates that the event leads to a significant decrease in the payoff only to informed traders of large firms, while there is little change in the payoff to other investors. The implications are two-fold, that the event is beneficial to market fairness for large firms although it has the drawback of discouraging informed traders from producing/sharing information; and secondly, the event has no universal and equivalent impact for different groups of investors.

Downloads

Published

2022-10-12

How to Cite

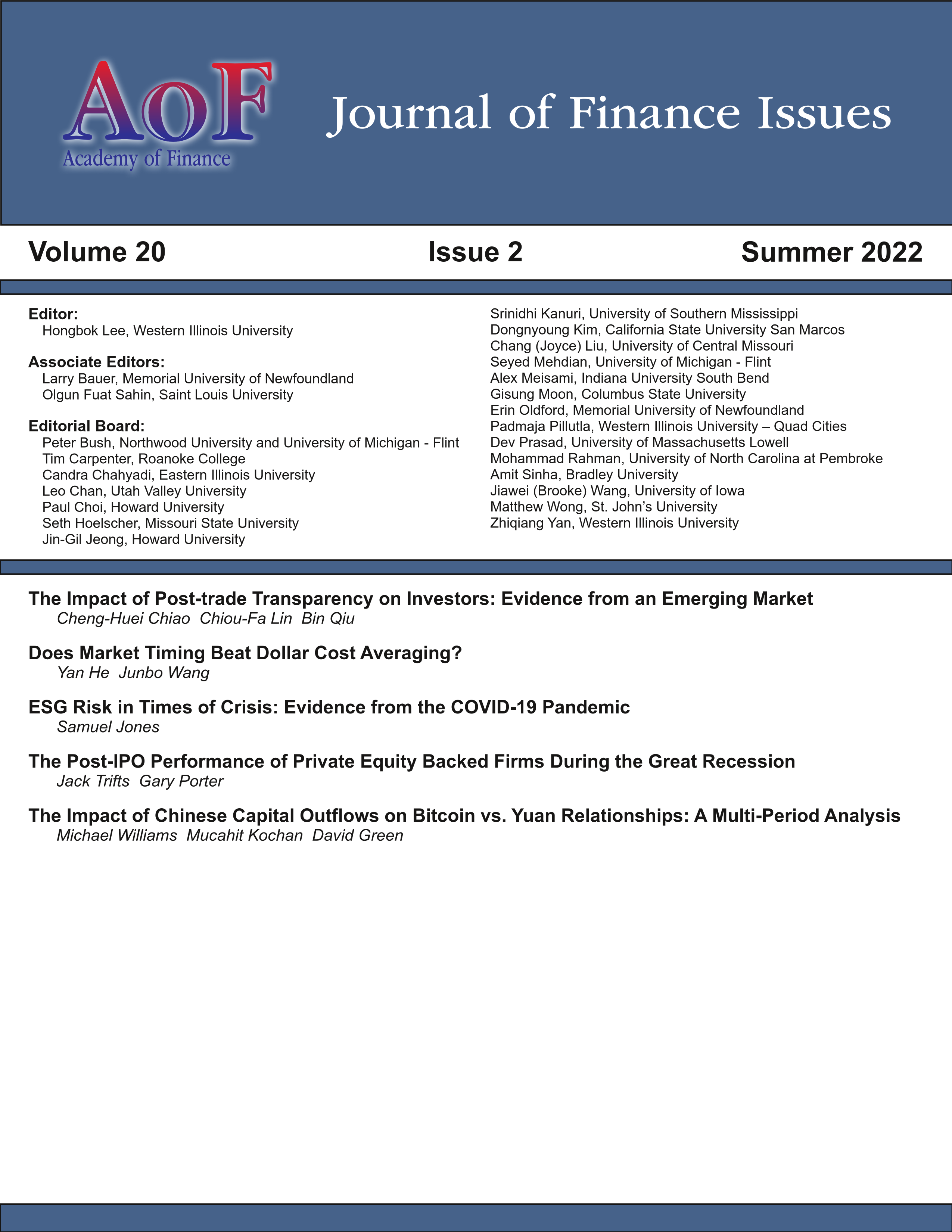

Chiao, Cheng-Huei, Chiou-Fa Lin, and Bin Qiu. 2022. “The Impact of Post-Trade Transparency on Investors: Evidence from an Emerging Market”. Journal of Finance Issues 20 (2):1-9. https://doi.org/10.58886/jfi.v20i2.3762.

Issue

Section

Original Article