An event study on the collapse of Silicon Valley Bank

DOI:

https://doi.org/10.58886/jfi.v21i2.6777Keywords:

Event Study, Large Banks, Too Big to Fail, SVB FailureAbstract

The failure of Silicon Valley Bank was one of the largest bank runs in American history. In this paper, we conducted an event study to discover the impact of SVB’s collapse on the returns of large banks in the US. Our results indicate that the collapse of Silicon Valley Bank had a negative impact on the top 20 banks. Pre-event estimation showed insignificant results as investors could not anticipate the collapse. On the contrary, we uncovered that most banks had significant adverse effects due to unfavorable market reactions in the post-event study.

Downloads

Published

2023-12-31

How to Cite

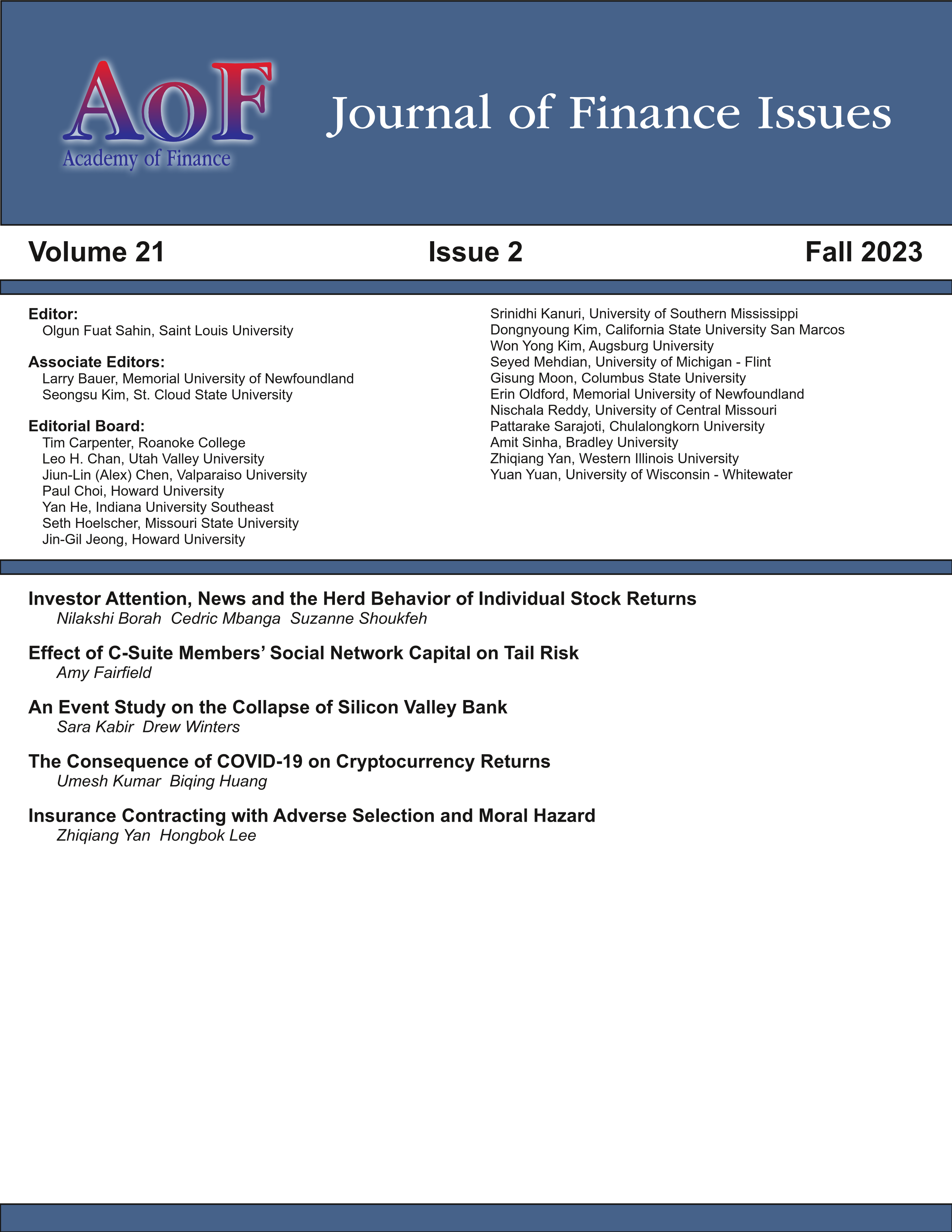

Kabir, Sara, and Drew Winters. 2023. “An Event Study on the Collapse of Silicon Valley Bank”. Journal of Finance Issues 21 (2):40-50. https://doi.org/10.58886/jfi.v21i2.6777.

Issue

Section

Original Article