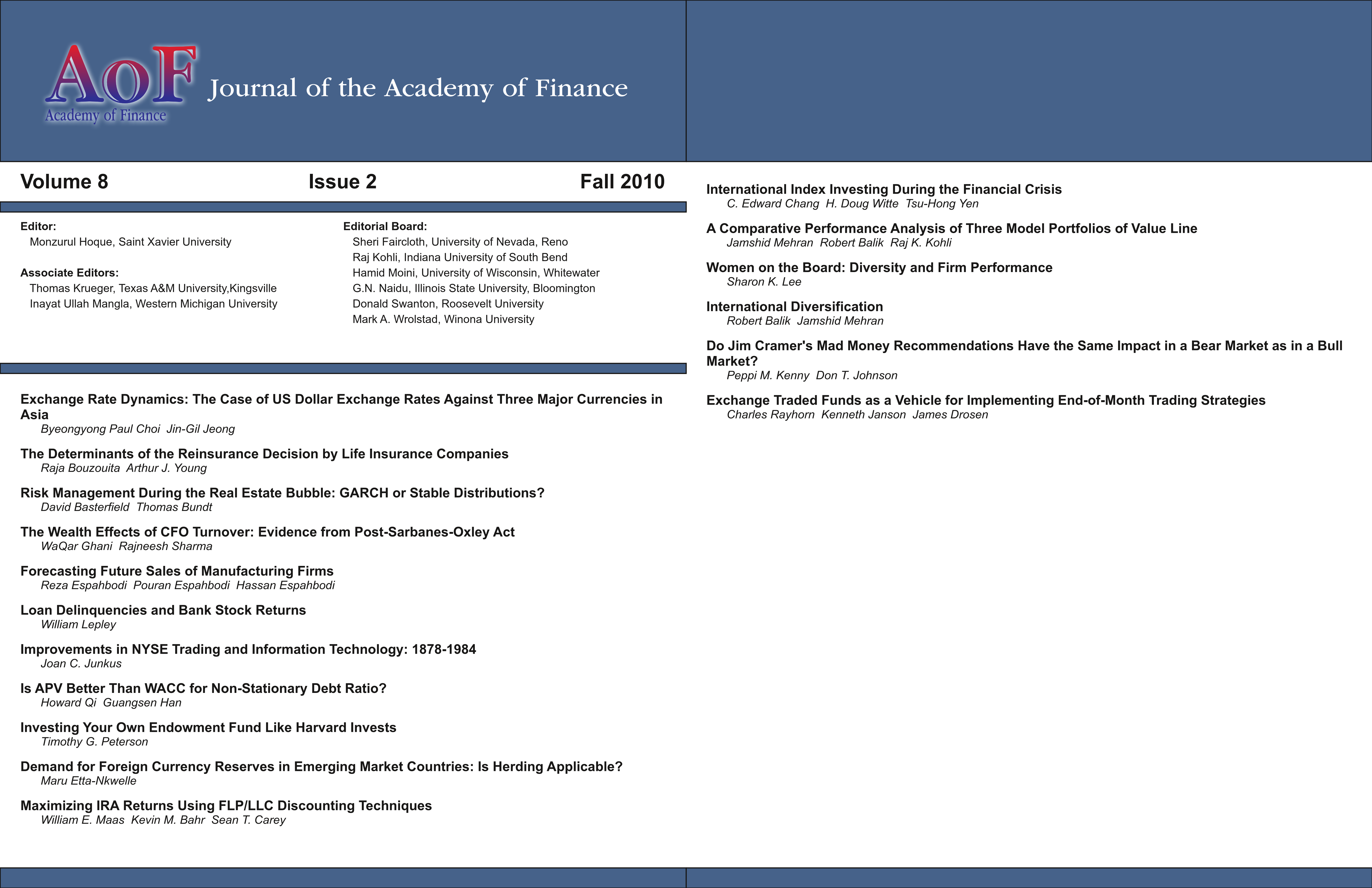

Women on the Board: Diversity and Firm Performance

DOI:

https://doi.org/10.58886/jfi.v8i2.2330Abstract

While there have been significant increases in recent years in the independence level on boards due to stricter regulations, there have been modest increases in women and minority board memberships. Women directors have accounted for 15% of all directors sitting on S & P 500 firms and just 9% for small-cap firms the last few years. Several recent studies have examined the possible relationship between the size and composition of the board of directors and firm performance. Specifically, a study of S & P 500 firms (Lee, Carlson 2008) shows that firms with relatively higher levels of independence on their boards perform significantly better. Adams and Ferreira (2009) conclude that gender diversity is helpful only for firms with weak governance. Is the board more effective when there is an inclusion of different views and perspectives? This study reports the inclusion of women on the board in different economic sectors and examines the possible effects of board gender diversity on firm performance.