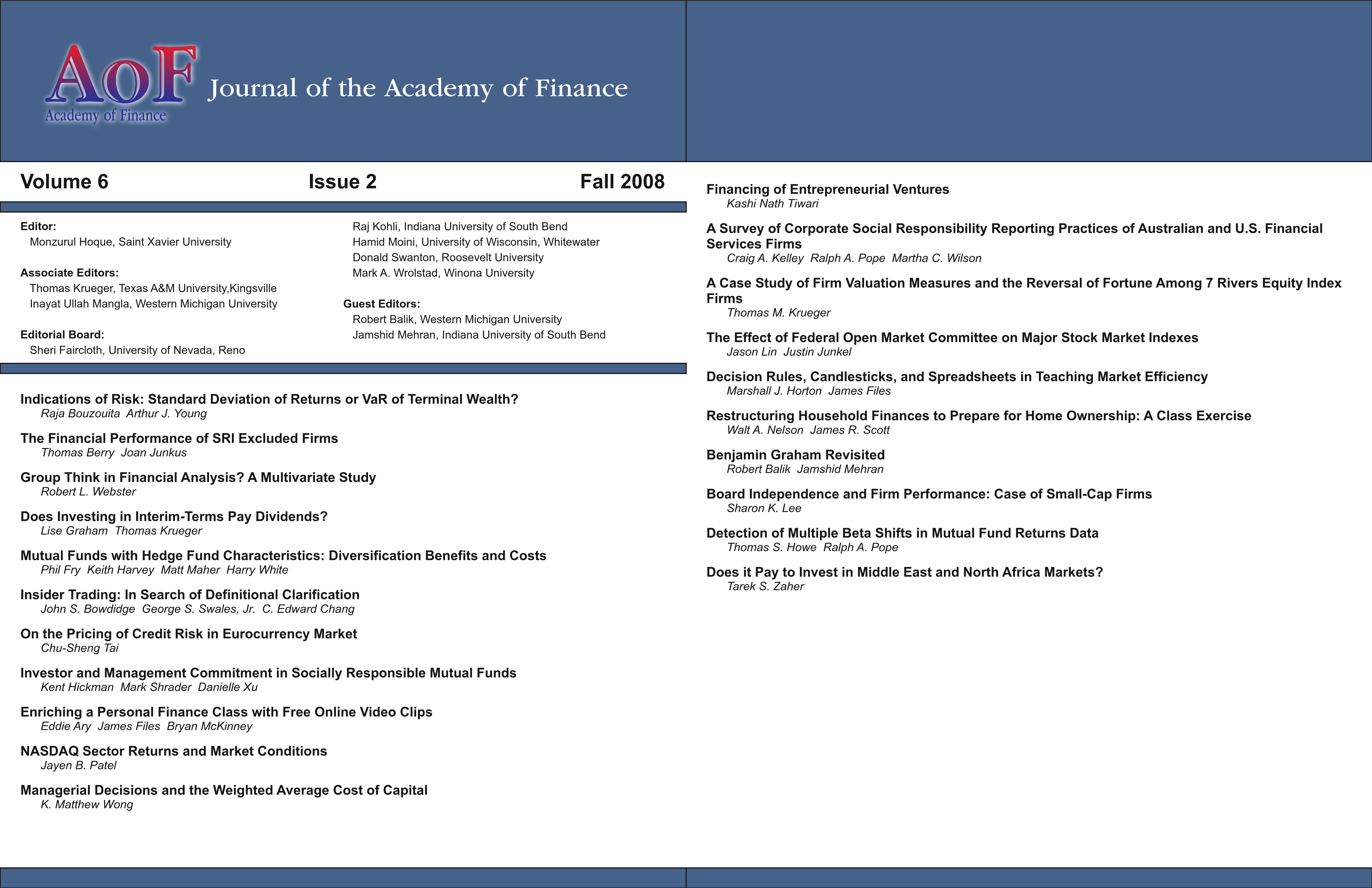

Board Independence and Firm Performance: Case of Small-Cap Firms

DOI:

https://doi.org/10.58886/jfi.v6i2.2398Abstract

Many changes in the size and composition of corporate boards of directors have occurred since the enactment of the 2002 Sarbanes-Oxley Act (SOX). With the new regulations, we have seen an increase in the number of independent board members and a decrease in the average size of boards. A recent study of S & P 500 firms [Lee, Carlson, 2007] shows that firms with the most independent boards perform significantly better than firms with less independent boards. Studies before the enactment of SOX found a significant inverse relationship between board size and firm performance. However, this relationship is not found in this study. In smaller firms, the goals of management and shareholders may be more aligned than that in larger firms such as the S & P 500. It is possible that the objective monitoring from a more independent board is not a significant factor in the performance of smaller firms. This study includes small-cap firms and examines the relationship between board independence and firm performance in small-cap firms.