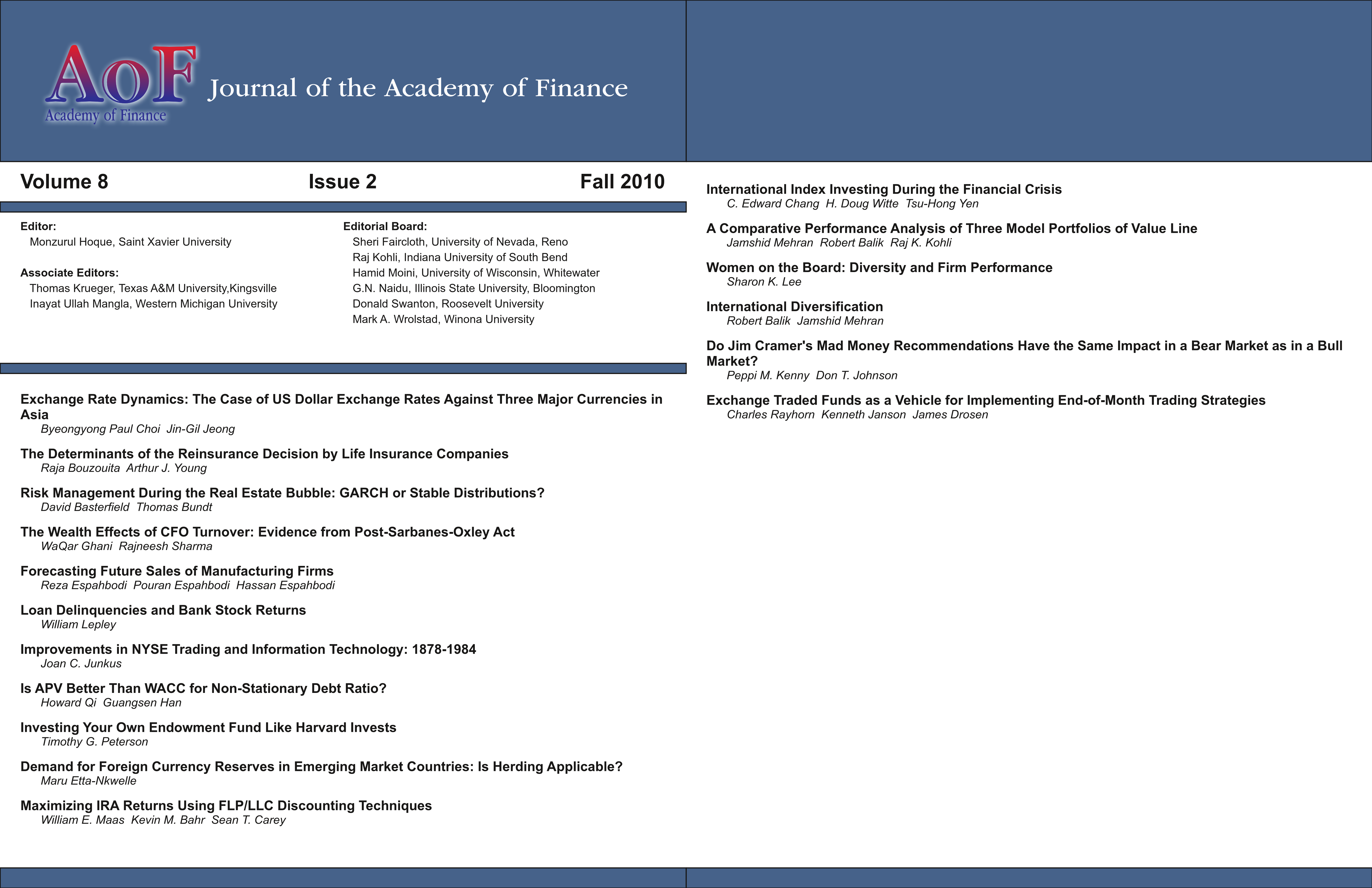

Exchange Traded Funds as a Vehicle for Implementing End-of-Month Trading Strategies

DOI:

https://doi.org/10.58886/jfi.v8i2.2327Abstract

An Exchange Traded Fund (ETF) is a retail investment product which is designed to mirror the returns of a basket of assets, typically the stocks which comprise a particular market index. ETFs provide an efficient mechanism for individuals to enter investment positions in a broad market or industry sector index. End-of-Month (EOM) trading involves the timed switching from cash to market exposure and then back to cash, in an attempt to capture higher returns than is available to a buy-and-hold alternative. The effectiveness of EOM has been demonstrated in a number of studies, but transaction costs and, very importantly, regulatory restrictions have been implementation impediments faced by individual investors. In this sturdy, ETFs are examined for implementation efficiency for individual retirement account investors who wish to employ an EOM trading strategy.