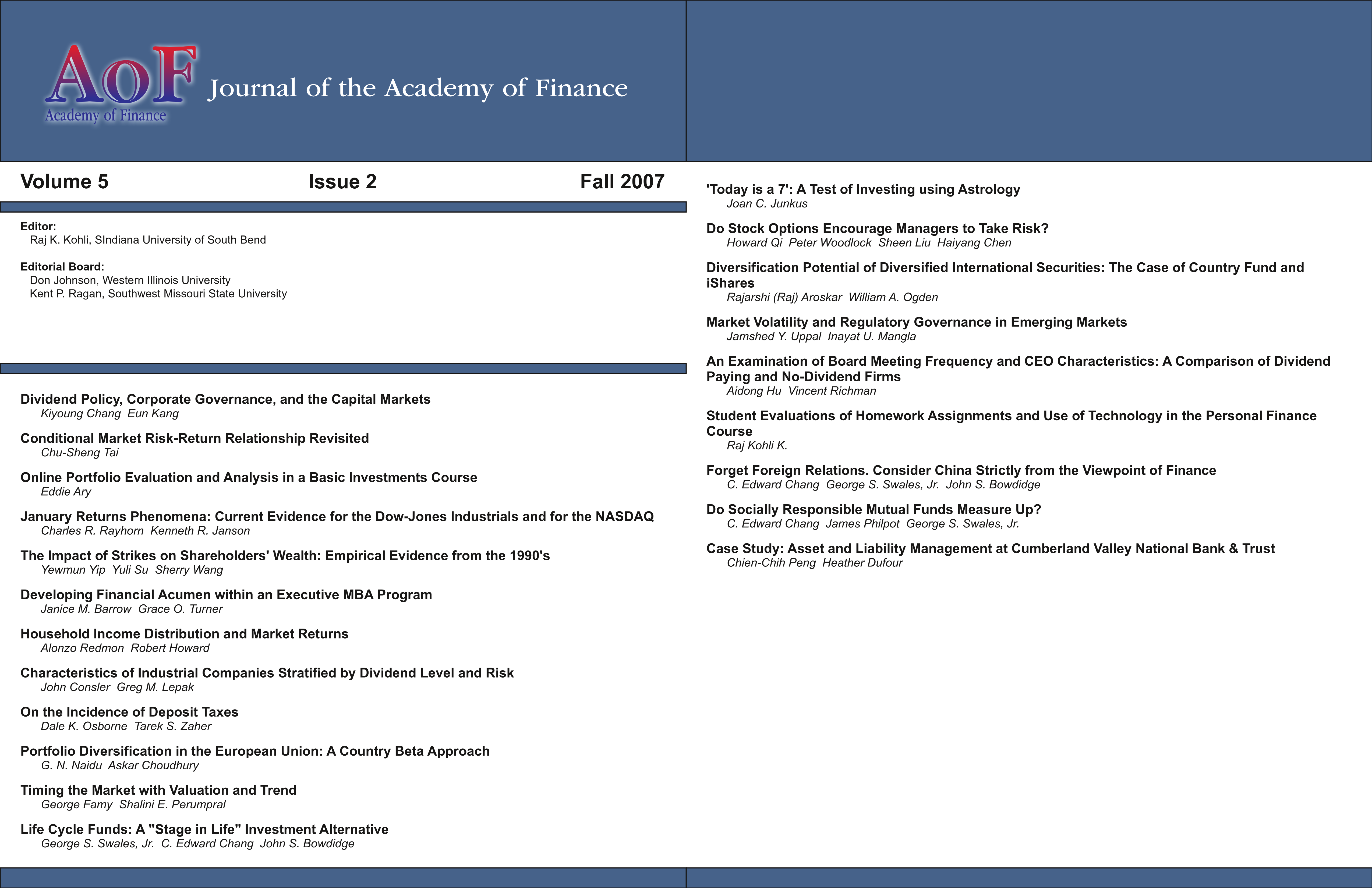

January Returns Phenomena: Current Evidence for the Dow-Jones Industrials and for the NASDAQ

DOI:

https://doi.org/10.58886/jfi.v5i2.2610Abstract

Two measures of stock performance are examined to gauge the extent of abnormal returns behavior attributable to the month of January. The January Effect (JE) and January Barometer (JB) are assessed on a large market capitalization portfolio, the Dow, and on a small market capitalization portfolio, the NASDAQ. The JE is confirmed for small capitalization firms over the period of study but is rejected for large capitalization firms. Evidence is found to support the JB effect for the large capitalization group. No evidence is found to support the JB effect for the small capitalization group.

Downloads

Published

2007-12-31

How to Cite

Rayhorn, Charles, and Kenneth Janson. 2007. “January Returns Phenomena: Current Evidence for the Dow-Jones Industrials and for the NASDAQ”. Journal of Finance Issues 5 (2):34-43. https://doi.org/10.58886/jfi.v5i2.2610.

Issue

Section

Original Article