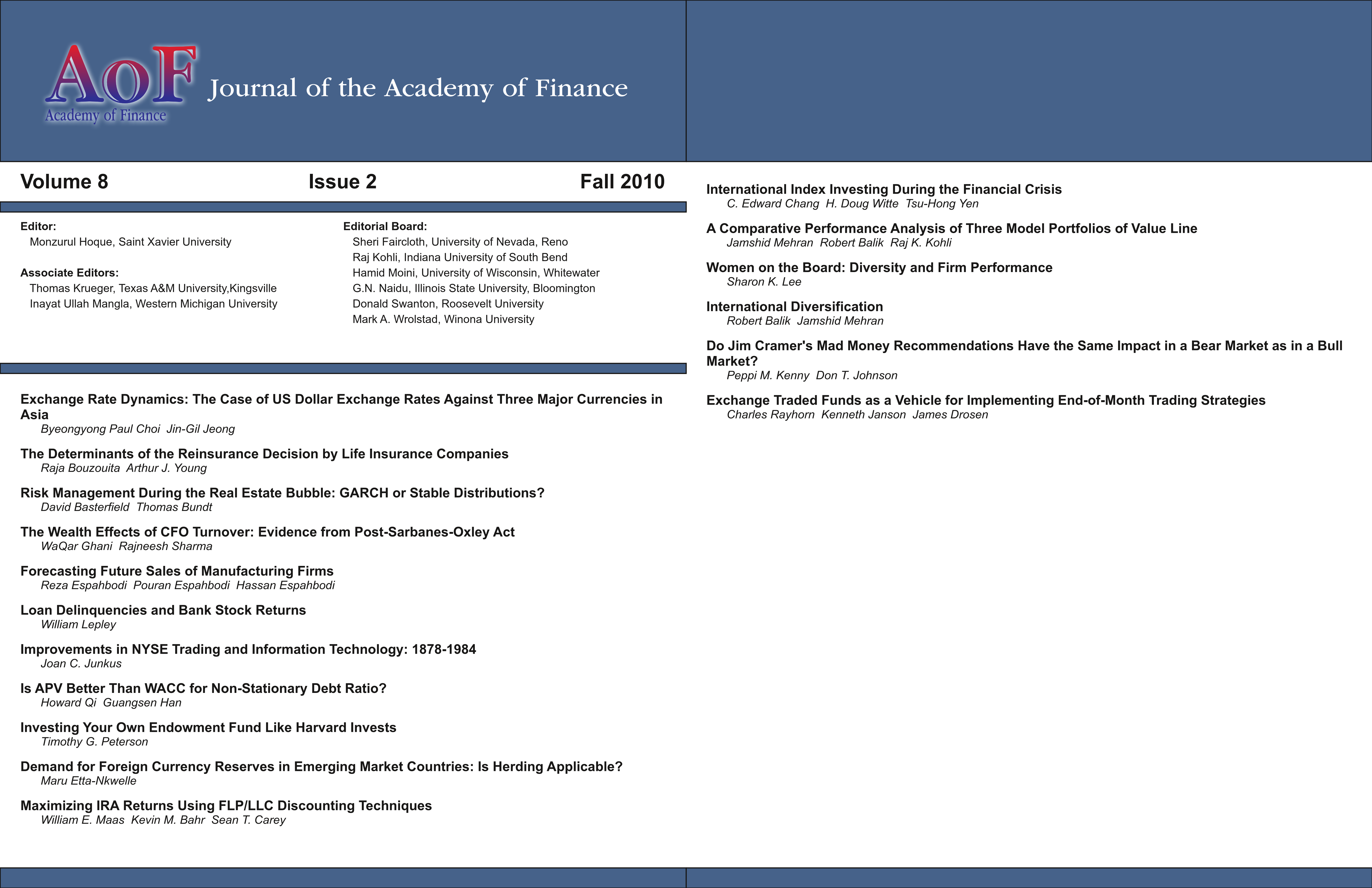

A Comparative Performance Analysis of Three Model Portfolios of Value Line

DOI:

https://doi.org/10.58886/jfi.v8i2.2331Abstract

Value Line timeliness weekly rankings puts out four model portfolios each containing 20 stocks. Portfolio stocks are added based on a "Timeliness" ranking and a "Financial Strength Rating" of at least B+. The Value Line Investment Survey has been the subject for many studies regarding market efficiency and Value Line’s ability to debunk this theory by delivering higher abnormal returns based on public information. The results of this study indicate that mean weekly abnormal rates of return statistically exists for three of the four portfolios. In addition, although statistically insignificant, variable HML’s betas for all three portfolios are negative indicating that the return movement between HML and each of the three model portfolios are in opposite direction.